Table of Contents

ToggleINDIA’S OIL IMPORTS FROM RUSSIA

TOPIC: (GS3) ECONOMY: THE HINDU

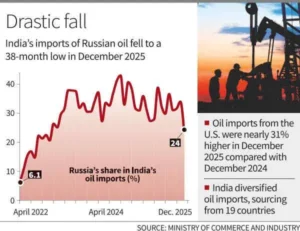

India’s crude oil imports from Russia fell to a 38month low in December 2025, dropping Russia’s share in India’s oil basket to 25% from 34% the previous month. This comes amid U.S. claims that India may reduce Russian oil purchases in exchange for lower tariffs.

Background

- India is one of the world’s largest importers of crude oil, meeting over 85% of its needs through imports.

- Since 2022, Russia became a major supplier to India due to discounted crude amid Western sanctions.

- Recent data shows a sharp decline in Russian oil imports, raising questions about India’s energy diversification strategy.

Import Trends

- Russian Oil Value: $2.7 billion in Dec 2025 – the lowest in more than three years.

- Russian Share in Basket: Declined to 24.9%, down from 34% in Nov 2025.

- Russian Volume: 5.8 million tonnes – the weakest since Feb 2025.

- U.S. Oil Value: $569.3 million in Dec 2025 – a 31% rise compared to Dec 2024.

- Diversification: India imported crude from 19 countries in Dec 2025, compared to 16 countries a year earlier.

U.S. Claims vs India’s Position

- U.S. Claim: President Trump stated India will stop Russian oil imports in return for tariff cuts on Indian goods (from 50% to 18%).

- India’s Response: No official confirmation; India emphasized diversification based on market conditions and global dynamics.

Economic Considerations

- Shipping Distance Matters: Importing oil from nearby regions like West Asia or Russia is cheaper compared to faraway suppliers such as the U.S. Gulf Coast or Venezuela.

- Cost Efficiency: Russian oil remains more affordable because of shorter transport routes and discounts offered, making it commercially attractive.

- Quality Factor: Venezuelan crude is heavier and more sulphur-rich, so it would only be viable if sold at a significant discount.

- Market Choice: India’s decisions are guided by balancing transport costs, crude quality, and pricing advantages rather than political commitments.

Strategic Implications

- India is balancing between economic pragmatism (cheaper Russian oil) and geopolitical pressures (U.S. push to reduce Russian dependence).

- Diversification helps India reduce risks of overreliance on any single supplier.

- Energy security remains a priority, with cost efficiency guiding decisions.

Way Forward

- Strengthen Diversification: India should continue expanding its crude oil sources beyond Russia and the U.S., ensuring a balanced energy basket to reduce risks from geopolitical tensions.

- Focus on Cost Efficiency: Negotiating better deals and discounts, while considering shipping costs and crude quality, will help India maintain affordable energy supplies.

- Enhance Strategic Autonomy: India must balance global pressures with national interests, keeping energy security decisions independent and guided by economic and practical considerations.

Conclusion

India’s declining Russian oil imports reflect both market dynamics and geopolitical pressures. While the U.S. claims a strategic shift, India’s stance highlights a pragmatic approach—choosing suppliers based on affordability, shipping distance, and discounts rather than political commitments.

CLIMATE GOVERNANCE ‘HOP-ON, HOP-OFF’ BUS ANALOGY

TOPIC: (GS3) ENVIRONMENT: THE HINDU

Former Environment Secretary C.K. Mishra compared global climate governance to “hop-on, hop-off” buses, highlighting lack of direction in climate negotiations.

Current State of Climate Governance

- CMP & CMA Meetings: Function like buses circling endlessly without obligation to reach climate goals.

- Politics Dominates: National interests override global urgency; consensus often means veto power for all.

- Economics Influence: Short-term profits outweigh long-term ecological concerns.

- Common People: Focused on immediate needs, they become victims of climate disasters rather than active stakeholders.

Role of Different Actors

- Scientists: Have already established risks and scenarios; delays now stem from politics, not science.

- Politicians: Manage expectations, postpone decisions, and avoid costs.

- Markets: Driven by opportunism, not precaution; future generations ignored in profit calculations.

- Individuals: Concerned with livelihood, not distant climate threats.

COP30 Outcomes

- Global Mutirão Package: Promoted cooperation but remained voluntary.

- 1.5°C Target: Politically unrealistic; emissions projected to cross threshold in early 2030s.

- Finance: Needs exceed $2.4–3 trillion annually; current flows under $400 billion. No binding timetable for funds.

- Adaptation: Pledge to triple finance lacked baseline or binding sources. Indicators adopted but unclear.

- Loss & Damage Fund: Opened for applications but underfunded.

- Technology Transfer: Announced programmes but lacked financial backing.

- Capacity Building & Just Transition: Strong statements, but no binding commitments or resources.

Structural Issues

- Drift, Not Collapse: Governance continues but remains inadequate.

- Voluntary Language: Encouragement without obligations.

- Gap Between Needs & Delivery: Climate urgency unmet by political will.

Way Forward

- Strengthen Binding Commitments: Move beyond voluntary pledges to enforceable obligations.

- Prioritise Finance & Adaptation: Ensure predictable funding for developing nations.

- Balance Justice & Pragmatism: Uphold common but differentiated responsibilities while ensuring global cooperation.

Conclusion

COP remains the only universal forum for coordinated climate response, despite flaws. The challenge is clear: while nations can “hop on and hop off” negotiations, humanity cannot hop off the planet.

ILLEGAL MINING IN MEGHALAYA

TOPIC: (GS3) ECONOMY: THE HINDU

On February 5, 2026, an explosion in an illegal rathole coal mine in Meghalaya killed at least 18 workers. The incident highlights persistent illegal mining despite bans and court supervision.

Background

- Rat-hole Mining: Small tunnels dug into coal seams without engineering safeguards; prone to collapse.

- Ban: National Green Tribunal prohibited rat-hole mining in 2014.

- Persistence: Mining continues due to local dependence on coal income, fragmented land ownership, and weak enforcement.

Problems with Illegal Mining

- Safety Hazards: Frequent accidents, collapses, and explosions; deaths often underreported.

- Health & Environment: Acid drainage, polluted water, unstable landscapes, degraded roads.

- Labour Issues: Informal labour market, child labour, and lack of worker records.

- Supply Chain Laundering: Illegal coal mixed with legal consignments, making detection difficult.

Governance Challenges

- Weak Enforcement: Local authorities struggle due to fragmented ownership and patronage networks.

- Court Supervision Limits: Judicial orders alone cannot replace active governance.

- Accountability Spread: Contractors and intermediaries dilute responsibility.

Measures Suggested

- Technology Use: GPS tracking for coal carriers. Satellite and drone monitoring integrated with control rooms.

- Community Monitoring: Involve local bodies; share penalties to incentivise vigilance.

- Target Intermediaries: Seizure of illegal consignments. Licence cancellations, prosecutions, and blacklisting from auctions.

- Alternative Livelihoods: Promote horticulture, construction, tourism, and small manufacturing. Public works to absorb displaced mining labour.

- Labour Protection: Allow workers to testify against contractors with amnesty. Pursue errant contractors aggressively.

Way Forward

- Raise Costs of Illegality: Make illegal mining financially and socially prohibitive.

- Provide Alternatives: Replace mining income with sustainable livelihood options.

- Strengthen Enforcement: Combine technology, community participation, and strict action against intermediaries.

Conclusion

Illegal mining in Meghalaya persists because bans alone are ineffective without economic alternatives, strict enforcement, and community involvement. The February 5 tragedy underscores the urgent need to make illegal mining both operationally impossible and socially unacceptable.

INDIA–EU TRADE DEAL

TOPIC: (GS3) ECONOMY: THE HINDU

India and the European Union (EU) recently concluded a longpending trade agreement after 25 years of negotiations.

Background

- Negotiations began in the late 1990s but faced repeated delays due to protectionist concerns and bureaucratic hurdles.

- Political trust built through frequent highlevel meetings since 2016 enabled progress.

- Previous trade deals with the UK and Australia helped India prepare for EU negotiations.

Drivers of the Agreement

- Political Diplomacy: Summitlevel engagement created trust and allowed leaders to invest political capital.

- Geopolitical Pressures: U.S. trade offensives under Trump. Economic coercion from China and Russia.

- Need for stable partnerships in a turbulent global order.

Strategic Dimensions Beyond Trade

- Defence & Security: Cooperation for maritime stability and freedom of navigation. Joint military exercises, information sharing, and IndoPacific security capacity building.

- Energy: EU’s decarbonisation goals align with India’s need for affordable sustainable energy. Opportunities in green hydrogen, renewable technologies, and resilient infrastructure.

- Technology: Collaboration on semiconductors, AI, digital public infrastructure, and data governance.

- Mobility: Easier visas and recognition of professional qualifications. Student, researcher, and skilled worker exchanges to strengthen innovation ecosystems.

Importance of the Deal

- Marks a strategic realignment, not just a trade pact.

- Offers India and EU a chance to jointly promote multipolarity, openness, and resilience.

- Can deliver tangible public goods across the IndoPacific and Global South, countering China’s influence.

Way Forward

- Expand Cooperation: Move beyond tariffs to defence, energy, technology, and peopletopeople ties.

- Ensure Implementation: Translate political alignment into binding commitments and practical projects.

- Build Interdependence: Create durable partnerships rooted in shared democratic values and longterm interests.

Conclusion

The India–EU trade deal is more than an economic agreement; it is the foundation of a strategic partnership. If sustained and broadened, this convergence could become a pillar of a more stable and multipolar international system.

DEEP TECH START-UPS

TOPIC: (GS3) ECONOMY: THE HINDU

The Department for Promotion of Industry and Internal Trade (DPIIT) has officially defined what qualifies as a deep tech start-up in India.

About Deep Tech Start-up

- Concerned with creating solutions based on new scientific or engineering knowledge.

- Must spend majority of funds on research and development (R&D).

- Owns or is developing novel intellectual property (IP) and working to commercialise it.

- Faces long gestation periods, high capital needs, and technical uncertainties.

Eligibility Criteria

- Normal Start-up: Less than 10 years old, turnover below ₹200 crore.

- Deep Tech Start-up: Can be recognised for up to 20 years, turnover limit raised to ₹300 crore.

- Must apply to DPIIT for certification. Certification decided by an Inter-Ministerial Board (includes DPIIT, Department of Science & Technology, Department of Biotechnology).

Restrictions

- Deep tech start-ups cannot invest in activities unrelated to their knowledge creation mandate.

- Prohibited from investing in real estate, speculative assets, shares, or securities, unless directly linked to their research.

Policy and Funding Support

- Linked to the Anusandhan National Research Foundation (NRF), custodian of ₹1 lakh crore Research and Development Innovation (RDI) Fund over seven years.

- Part of this fund will support deep tech start-ups. Financing may be available at concessional rates of 2%–4% with long tenures up to 15 years.

- A deep tech policy was drafted in July 2023 by the Principal Scientific Adviser’s office, awaiting Cabinet approval.

Importance

- Provides clarity for investors, innovators, and policymakers.

- Encourages long-term innovation in areas with high risk but transformative potential.

- Aligns with India’s push for technology-driven growth and global competitiveness.

Conclusion

The new definition and framework for deep tech start-ups give them a longer runway, financial support, and regulatory clarity. This step strengthens India’s innovation ecosystem and ensures that high-risk, high-reward ventures can thrive with proper recognition and support.

RBI MONETARY POLICY

TOPIC: (GS3) ECONOMY: THE HINDU

The Reserve Bank of India (RBI) has kept the repo rate unchanged at 5.25% with a neutral stance.

Policy Decision

- Repo Rate: RBI has kept the repo rate steady at 5.25%.

- Policy Stance: Neutral, with decisions guided by evolving macroeconomic conditions.

- Domestic Outlook: Inflation and growth remain positive despite global challenges.

- Inflation Projection: CPI inflation expected at 4% in Q1 FY27 and 4.2% in Q2 FY27, with precious metals driving slight upward revision.

- Growth Projection: Real GDP growth revised upwards to 6.9% in Q1 FY27 and 7% in Q2 FY27.

Inflation Outlook

- CPI Inflation Projections: Q1 FY27 → 4%, Q2 FY27 → 4.2%

- Drivers of Revision: Increase in prices of precious metals (adding 60–70 basis points).

- Core Inflation: Expected to remain stable, barring volatility in metals and energy prices.

- Risks: Geopolitical tensions, energy price fluctuations, and adverse weather events.

Growth Outlook

- Resilient Economy: Domestic activity remains strong.

- GDP Projections: Q1 FY27 → 6.9%, Q2 FY27 → 7%

- Balanced Risks: Growth outlook favourable; projections for full year deferred until new GDP series release.

External & Global Context

- Positive Factors: Successful trade deals support outlook.

- Challenges: Rising geopolitical frictions and trade tensions disrupting global economic order.

Liquidity Management

- RBI to remain proactive in ensuring adequate liquidity for productive needs.

- Measures: Preemptive liquidity management. Allowance for fluctuations in government balances. Forex interventions when necessary.

Importance

- Stable policy rate supports growth while keeping inflation near target.

- Revised projections indicate confidence in India’s macroeconomic fundamentals.

- RBI balancing domestic resilience with global uncertainties.

GULF COOPERATION COUNCIL (GCC)

TOPIC: (GS2) INTERNATIONAL RELATIONS: THE HINDU

India and the Gulf Cooperation Council (GCC) recently signed the Terms of Reference for a Free Trade Agreement (FTA) in New Delhi.

About GCC

- Established: 1981 as a regional political and economic alliance.

- Members: Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and UAE.

- Objective: Promote cooperation in economy, security, culture, and social development.

- Background: Formed in response to regional instability after the Iranian Revolution (1979) and Iran–Iraq War (1980–88).

- Headquarters: Riyadh, Saudi Arabia.

Organizational Structure

- Supreme Council: Heads of member states; meets annually; presidency rotates alphabetically.

- Ministerial Council: Composed of foreign ministers; proposes policies and implements decisions.

- Secretariat General: Prepares studies, coordinates projects, and enhances integration among members.

India–GCC Free Trade Agreement

- India’s Exports to GCC: Engineering goods, rice, textiles, machinery, gems, and jewelry.

- India’s Imports from GCC: Crude oil, LNG, petrochemicals, and precious metals like gold.

- Significance: Strengthens India’s energy security. Expands market access for Indian industries.

Importance of the Agreement

- Enhances India’s trade diversification and reduces dependence on other regions.

- Builds stronger economic interdependence with Gulf nations.

- Supports India’s long-term energy and export growth strategy.

Conclusion

The India–GCC FTA framework is a strategic milestone that goes beyond trade, reinforcing India’s economic resilience and geopolitical engagement with the Gulf region.

BRICS CENTRE FOR INDUSTRIAL COMPETENCIES

TOPIC: (GS3) ECONOMY: THE HINDU

India has formally joined the BRICS Centre for Industrial Competencies (BCIC) at Vanijya Bhavan, New Delhi.

BRICS Centre for Industrial Competencies

- Launch: Established in partnership with the United Nations Industrial Development Organization (UNIDO).

- Objective: Acts as a onestop hub to provide integrated support for manufacturing firms and MSMEs.

- Focus Areas: Strengthening Industry 4.0 skills. Promoting industrial modernization. Supporting digital transformation in BRICS economies.

- Implementation in India: The National Productivity Council (NPC) designated as the India Centre.

- Nature: A networkdriven initiative connecting BRICS countries for industrial cooperation.

About BRICS

- Origin: Term ‘BRIC’ coined in 2001 by economist Jim O’Neill.

- First Meeting: 2006 during G8 Outreach Summit; first standalone summit in 2009 (Russia).

- Expansion: South Africa joined in 2010 → BRIC became BRICS.

- Aim: Strengthen SouthSouth cooperation and amplify the voice of developing nations in global governance.

- Members (2026): Brazil, Russia, India, China, South Africa, Saudi Arabia, UAE, Iran, Egypt, Ethiopia, and Indonesia.

Significance of BCIC for India

- Provides Indian MSMEs access to global industrial networks.

- Enhances competitiveness through technology transfer and skill development.

- Supports India’s push for digital transformation and innovationdriven growth.

- Strengthens India’s role in BRICS as a hub for industrial modernization.

Conclusion

India’s entry into the BRICS Centre for Industrial Competencies is a strategic step to boost MSMEs, industrial innovation, and digital capabilities. It reinforces India’s leadership in shaping Industry 4.0 and deepening cooperation among emerging economies.

SARUS CRANE

TOPIC: (GS3) ENVIRONMENT: THE HINDU

Why in News?

A recent census in Uttar Pradesh recorded an increase of 634 birds (≈3% rise) in one year across multiple forest divisions. The state continues to hold the largest population of Sarus Cranes in India.

About Sarus Crane

The Sarus Crane (Antigone antigone) is the world’s tallest flying bird and a key indicator of wetland ecosystem health. Its survival reflects the condition of agricultural wetlands and traditional water bodies in northern India.

Habitat & Distribution

- Prefers freshwater wetlands — marshes, ponds, canals, flooded fields.

- Often seen near human settlements, especially in paddy-growing regions.

- Major Indian presence in the Gangetic Plains and eastern Rajasthan.

- Numbers decline toward peninsular India due to habitat loss.

- Also found in parts of Southeast Asia and northern Australia.

- Non-migratory species (resident bird).

Physical & Behavioral Traits

- Height: Up to 1.8 m, making it the tallest flying bird globally.

- Appearance: Grey body, bare red head and upper neck, pinkish-red legs.

- Among cranes, considered least gregarious — usually in pairs or small groups.

- Monogamous; pairs often remain together for life.

- Nests built on shallow water platforms in wetlands or flooded farms.

- Lifespan: Around 30–40 years in the wild.

Ecological Importance

- Acts as a flagship wetland species.

- Helps in pest control and maintains food chain balance.

- Presence signals healthy agro-wetland systems.

Threats

- Wetland drainage and urban expansion.

- Pesticide use in agriculture.

- Power line collisions.

- Decline in traditional water bodies.

Conservation Status

- IUCN Red List: Vulnerable (via International Union for Conservation of Nature)

- CITES: Appendix II (regulated trade under Convention on International Trade in Endangered Species)

- Protected under India’s Wildlife Protection framework.