Table of Contents

ToggleEV BOOM AND COPPER CRUNCH

TOPIC: (GS3) ECONOMY: THE HINDU

The rapid growth of electric vehicles (EVs) worldwide has triggered a sharp rise in copper demand, leading to fears of a global supply deficit.

Copper and EV Transition

- Copper is essential for EV batteries, motors, wiring, charging stations, and power grids.

- EVs consume 4–5 times more copper than conventional vehicles.

- Between 2015–2025: EV sales rose from 0.55 million to 20 million units. Copper use surged from 27,500 tonnes to 1.28 million tonnes.

- Shows copper as the hidden backbone of the EV revolution.

Copper Demand Elasticity

- There is a direct and strong connection between electric vehicle (EV) sales and copper demand.

- Between 2016 and 2024, copper demand grew faster than EV sales, with elasticity staying above 1.0.

- In 2019, elasticity peaked at 1.76, mainly due to larger battery sizes and rapid expansion of charging infrastructure.

- By 2025, elasticity is expected to decline to around 0.90, but overall copper demand will continue to rise because of the sheer scale of EV adoption.

Global Copper Deficit

- Supply growth constrained by: Declining ore quality. Long timelines (10–15 years) for new mines. Environmental opposition in Chile, Peru, U.S.

- Demand vs Supply: 2026: Demand ~30 million tonnes; Supply ~28 million tonnes. 2030: Deficit may reach 8 million tonnes (equal to output of 10 largest mines).

- Impact: Higher EV costs, slower charging infrastructure, pressure on climate targets.

Challenges

- Copper Deficit: Global demand projected at 30 million tonnes in 2026, while supply will be only 28 million tonnes.

- Rising EV Costs: EVs require 4–5 times more copper than petrol/diesel vehicles. Shortages could raise EV prices by 10–15%, slowing adoption.

- Funding Slowdown: India’s startup funding fell to $10.5 billion in 2025, down 17% from 2024. Higher compliance and resource costs may worsen this trend.

- Geopolitical Competition: China already consumes ~60% of global EV-related copper.Its demand rose from 78,000 tonnes in 2020 to 6,78,000 tonnes in 2024

Way Forward

- Expand mining capacity with faster approvals and sustainable practices.

- Boost recycling of copper from old electronics and vehicles.

- Invest in material innovation to reduce copper intensity in EVs.

- Diversify supply chains to reduce dependence on a few countries.

- Strategic planning by governments to balance green transition with resource security.

Domestic Manufacturing & Import Dependence Of Copper

- Falling Production: Domestic copper output dropped from 843 kilo tonnes (KT) in FY18 to 573 KT in FY25.

- Rising Demand: Copper demand surged to 840 KT in FY24, driven by EV adoption, renewable energy, and electronics.

- Import Dependence: India meets over 90% of copper concentrate needs through imports. Dependency projected to rise to 97% by 2047 if no strategic intervention is made.

- Limited Domestic Mining: Mined copper contributes only 3–5% of total consumption; most raw material is imported.

- Trade Share: Copper and its articles made up 1.7% of India’s total imports in FY25, growing 28% year-on-year.

Conclusion

The EV revolution is not just about batteries and technology but also about resource strategy. Copper has become the lifeline of electrification, and without bold action on supply and recycling, the pace of the green transition will be dictated by geology, not ambition.

INDIA’S DEFENCE DIPLOMACY

TOPIC: (GS2) INTERNATIONAL RELATIONS: THE HINDU

UAE President Sheikh Mohamed bin Zayed Al Nahyan made a brief visit to Delhi, announcing plans for an India–UAE Strategic Defence Partnership, the first of its kind.

India–UAE Ties

- UAE is India’s third-largest trading partner and second biggest export destination.

- It is also the seventh largest foreign investor in India.

- In 2022, India signed its first bilateral trade agreement with the UAE.

- Current agreements include:

- Doubling trade to $200 billion.

- A $3 billion LNG deal.

- UAE investments in Gujarat.

Defence Partnership Announcement

- Framework for a Strategic Defence Partnership under discussion.

- First such defence pact between India and a Gulf nation.

- Seen as significant given the volatile security environment in West Asia and South Asia.

Regional Context

- UAE–Saudi tensions: Once allies against the Houthi rebellion, now in rivalry over Sudan and regional influence.

- Iran unrest: Protests and U.S. threats of intervention add instability.

- Gaza ceasefire: Fragile, with U.S. proposing a “Board of Peace”.

- Israel–Qatar conflict (2025): Prompted Saudi Arabia to sign a defence pact with Pakistan, with talks of Türkiye joining.

- Region increasingly fragmented, raising risks for India’s interests.

India’s Concerns

- Nearly 10 million Indians live in Gulf countries, making stability vital.

- GCC region is a major energy supplier for India, especially after sanctions on other sources.

- Connectivity projects like Chabahar Port, International North-South Transport Corridor, and India–Middle East–Europe Economic Corridor depend on regional cooperation.

- India must avoid being drawn into rival blocs while safeguarding its economic and diaspora interests.

Challenges

- Maintaining balanced diplomacy with multiple Gulf powers such as the UAE, Saudi Arabia, Iran, and others, without favouring one over the other.

- Avoiding the perception of military entanglement, ensuring defence cooperation does not drag India into regional rivalries.

- Safeguarding energy security and connectivity projects, as ongoing instability in West Asia poses risks to India’s vital oil supplies and strategic corridors like Chabahar and the India–Middle East–Europe Economic Corridor.

Way Forward

- Pursue defence cooperation with caution, focusing on technology, training, and maritime security rather than military entanglements.

- Maintain strategic autonomy and avoid taking sides in Gulf rivalries.

- Strengthen economic and energy partnerships while supporting regional stability through diplomacy.

Major Military Agreements of India with Other Nations

United States

- LEMOA (Logistics Exchange Memorandum of Agreement, 2016): Allows mutual access to each other’s military bases for refuelling and supplies.

- COMCASA (Communications Compatibility and Security Agreement, 2018): Enables secure communication systems and interoperability between forces.

- BECA (Basic Exchange and Cooperation Agreement, 2020): Provides access to advanced geospatial intelligence for precision targeting.

- 10-Year Defence Framework (2025): Focus on co-development of advanced defence systems, supply chain resilience, and technology transfer.

Russia

- Long-standing defence partner; agreements include joint production of BrahMos missiles and technology transfer in fighter aircraft and tanks.

- Regular military exercises like Indra strengthen operational cooperation.

France

- Strategic partnership covering Rafale fighter jets and Scorpene-class submarines.

- Defence cooperation includes joint exercises (Varuna) and technology sharing.

Israel

- Defence agreements on missile defence systems, drones, and electronic warfare.

- Close collaboration in cybersecurity and AI-based defence technologies.

Australia & Japan

- Mutual Logistics Support Agreements (MLSA): Allow reciprocal access to bases, fuel, and supplies.

- Cooperation under Quad framework for maritime security and Indo-Pacific stability.

Conclusion

India’s proposed defence pact with the UAE is a landmark step but comes at a sensitive time. With multiple faultlines in the Gulf, India must tread carefully, balancing strategic interests with its long-term vision of stability and connectivity in West Asia.

INDIA–CHINA FDI RELATIONS

TOPIC: (GS3) ECONOMY: THE HINDU

India is preparing to lift restrictions on Chinese foreign direct investment (FDI) imposed in 2020 after the Galwan Valley clash.

India’s Curbs on Chinese FDI

- Policy Curbs (2020): After border clashes, India introduced Press Note 3, requiring prior government approval for investments from countries sharing land borders.

- Economic Impact: As a result, Chinese companies were unable to access contracts valued at nearly $700–750 billion.

- Historic Investment Pattern: Between 2000 and 2021, direct Chinese FDI into India remained very low, contributing less than 1% of total inflows.

- Indirect Routes Blocked: Earlier, Chinese investments often came indirectly through tax havens, but the 2020 restrictions disrupted this channel as well.

India’s Changing Approach

- Economic Survey 2023–24: Suggested Chinese FDI could help India integrate into global supply chains and boost exports.

- Global Context: U.S. and EU reduced direct trade with China in 2023–24. India sees opportunity to position itself as an alternative hub.

- Without including Chinese firms, India may struggle to attract diversified supply chains due to China’s dominance in global markets.

Case Study – Smartphones

- In 2016, China supplied 60% of U.S. smartphone imports.

- By 2026, share fell to 22% due to tariffs.

- Countries like Vietnam, Thailand, and India increased their shares.

- India succeeded in smartphones but replicating this across other sectors may be difficult without Chinese participation.

FDI Trends

- China’s cumulative FDI stock has grown globally but declined in India.

- Between 2014–2024, India’s rank among Chinese FDI destinations fell by 19 places.

- Perception of India as an unpredictable investment environment discouraged Chinese firms.

Challenges

- Political mistrust due to border tensions.

- Risk of overdependence on Chinese capital.

- Need to balance national security with economic opportunity.

- Competition from other Asian economies (Vietnam, Thailand) attracting supply chains.

Way Forward

- Provide clear and stable investment policies to rebuild investor confidence.

- Encourage joint ventures in non-sensitive sectors like electronics, renewable energy, and infrastructure.

- Maintain strategic autonomy by diversifying FDI sources beyond China.

- Use Chinese participation selectively to strengthen India’s role in global supply chains.

What is FDI?

FDI is when a foreign entity invests directly in businesses or assets in another country, usually by acquiring ownership or controlling interest.

- Regulated under the Foreign Exchange Management Act (FEMA), overseen by the Department for Promotion of Industry and Internal Trade (DPIIT).

- Forms of FDI:

- Greenfield investments (new projects).

- Brownfield investments (mergers, acquisitions, joint ventures).

- Threshold: Generally, a stake of 10% or more in a company is considered FDI.

Major Source Countries of FDI in India (FY25)

- Singapore – 30–34% share of total inflows.

- United States – 19–30% share.

- Mauritius – 10–17% share.

- United Arab Emirates – 5–7% share.

- Cayman Islands / Cyprus – 5–6% share. Together, Singapore and USA contribute more than half of India’s FDI inflows.

Major Sectors Attracting FDI (FY25)

- Computer Software & Hardware – ~29% share.

- Services Sector (financial, business, IT-enabled) – ~18–19% share.

- Automobile Industry – ~7% share.

- Drugs & Pharmaceuticals – ~6% share.

Conclusion

India’s decision to ease curbs on Chinese FDI reflects economic pragmatism. While Chinese investment could help India integrate into global supply chains, caution is essential to balance security concerns with economic gains.

HIGH SEAS TREATY AND INDIA’S DOMESTIC FRAMEWORK

TOPIC: (GS2) INTERNATIONAL RELATIONS: THE HINDU

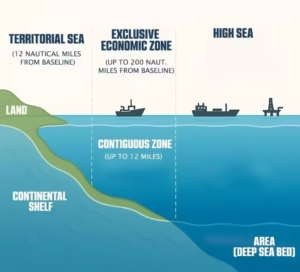

The High Seas Treaty (BBNJ Agreement) under UNCLOS will come into force on 17 January 2026, enabling the creation of marine protected areas in international waters for the first time. India has started preparing a domestic framework to implement the treaty, given its implications for fisheries, marine genetics, and ocean governance.

High Seas Treaty

- A global accord to protect marine biodiversity in high seas and deep seabed beyond national jurisdiction.

- Covers two-thirds of the world’s oceans.

- Provides a legal framework to:

- Conserve marine ecosystems.

- Promote sustainable use of ocean resources.

- Ensure fair sharing of benefits from marine genetic materials.

Four Pillars of the Treaty

- Marine Genetic Resources & Benefit Sharing – equitable access to discoveries from deep-sea organisms.

- Area-Based Management Tools – creation of Marine Protected Areas (MPAs) in international waters.

- Environmental Impact Assessments – mandatory evaluation of activities affecting fragile ecosystems.

- Capacity Building & Technology Transfer – support for developing countries in ocean research and conservation.

Why is it a Landmark?

- First-time legal protection for biodiversity in international waters.

- Closes governance gaps on marine genetic resources and conservation.

- Applies at a global scale, covering nearly two-thirds of oceans.

Timing Significance

- Triggered by Morocco’s ratification in September 2025.

- Aligns with the UN 2022 biodiversity goal to protect 30% of land and oceans by 2030.

- Comes as deep-sea exploration and mining applications are under review.

India’s Preparations

- Institutional Coordination: Ministry of Earth Sciences held consultations with ICAR-CMFRI and CMLRE.

- Stakeholder Integration: Inputs from policymakers, scientists, legal experts, and fisheries industry.

- Roadmap Formation: Recommendations for India’s domestic framework ahead of the Conference of Parties (August 2026).

Governance Gaps Addressed

- Clarifies ownership and access to marine genetic resources.

- Establishes accountability through environmental impact assessments.

- Balances conservation with interests of coastal and developing nations.

Importance for India

- High seas activities affect fish stocks within India’s EEZ.

- Strengthens India’s role in ocean science, technology, and policy.

- Direct relevance for small-scale fisheries, sustainability, and food security.

Challenges

- Enforcement limited under international law; depends on cooperation.

- Some major powers (e.g., U.S.) have not ratified, affecting universality.

Conclusion

The High Seas Treaty transforms oceans from a regulatory vacuum to a governed commons. India’s proactive domestic alignment shows strategic intent to safeguard fisheries, integrate science with law, and contribute to global ocean governance.

PAX SILICA AND INDIA’S STRATEGIC IMPORTANCE

TOPIC: (GS3) ECONOMY: THE HINDU

The U.S. convened the first Pax Silica Summit (December 2025) to secure supply chains for semiconductors, AI, and critical minerals. India, though not invited initially, is expected to join soon, as confirmed by the new U.S. Ambassador.

About Pax Silica

- Meaning: Pax Silica combines “Pax” (peace) with “Silica” (a key material in chip-making), symbolising secure and peaceful technology supply chains.

- Objective: The initiative aims to create trusted digital infrastructure, reduce dependency on single sources, and ensure resilience in global semiconductor and AI supply chains.

- Key Focus Areas: Strengthening access to Rare Earth Elements (REEs), advancing semiconductor manufacturing, and building robust AI ecosystems for future technologies.

- Additional Point: It also seeks to promote international cooperation among technology leaders and resource-rich nations to counter supply chain vulnerabilities.

Major Participants

- Technology leaders: U.S., Japan, South Korea, Netherlands, Singapore, Israel, U.K.

- Resource-rich nations: Australia (Lithium, REEs), Qatar & UAE (investment funds).

- Observers: Canada, EU, OECD, Taiwan.

- Membership evolving, with India likely to be included.

Countering China

- China dominates REE supply chains and has used export restrictions for political leverage.

- India faced disruption in rare-earth magnet imports, affecting automobile and electronics industries.

- Pax Silica aims to create an alternative supply chain to reduce dependence on China.

India’s Role and Opportunities

- Strengths:

- Strong digital infrastructure.

- Rapidly growing AI market.

- Launch of AI and Semiconductor Missions with major funding.

- Investments by Indian firms (Tata) and U.S. companies (Micron).

- Collaboration with Japan, Singapore, and Israel in semiconductor projects.

- Human Capital: Large pool of engineers trained in AI/semiconductors, many returning from U.S. universities.

- Potential Gains:

- Scale-up collaborations with Pax Silica members.

- Strengthen domestic semiconductor and AI ecosystems.

- Enhance resilience in supply chains.

Challenges for India

- India would be the first developing country and first non-U.S. ally to join Pax Silica → possible expectation gap.

- India’s semiconductor and AI sectors are still nascent compared to other members.

- India may prefer subsidies, procurement support, and import regulations to protect domestic firms, which may clash with Pax Silica’s free-market orientation.

- Must balance participation with strategic autonomy.

Way Forward

- Engage in detailed dialogue before joining to clarify expectations.

- Use Pax Silica membership to attract investment and technology transfer.

- Continue parallel initiatives like Quad Critical Minerals Initiative and Supply Chain Resilience Initiative.

- Position itself as a bridge between developed and developing countries in global tech governance.

Conclusion

Pax Silica represents a new geopolitical and technological framework to counter China’s dominance in REEs and secure AI/semiconductor supply chains. For India, joining offers opportunities to strengthen its tech ecosystem, but careful navigation is needed to protect strategic autonomy and domestic interests.

REUSABILITY AND SUSTAINABLITY IN SPACE LAUNCH

TOPIC: (GS3) SCIENCE AND TECHNOLOGY: THE HINDU

Reusable rocket technologies are transforming the commercial space industry, reducing launch costs and increasing mission frequency. With the global space market projected to cross $1 trillion by 2030, reusability is seen as the biggest game-changer.

Background

- Earlier, space exploration was government-led; now private firms dominate.

- Traditional expendable rockets discarded stages after use, making launches costly.

- Reusability shifts the model from “disposable” to “transportation”, similar to airlines.

Efficiency of Rocket Launches

- Human missions cost 3–5 times more than satellite launches due to life-support and safety systems.

- Rockets face hurdles: gravity and aerodynamic drag.

- Tsiolkovsky equation: Shows rockets carry >90% of mass as fuel, leaving <4% for payload.

- Staging: Used to shed dead weight mid-flight, improving efficiency.

Global Developments in Reusability

- SpaceX:

- Pioneered reusable first stages (Falcon 9).

- Recovered boosters over 520 times.

- Developing Starship, a fully reusable rocket for Earth orbit, Moon, and Mars.

- Blue Origin: Demonstrated vertical landing recovery with New Glenn booster.

- China: Companies like LandSpace testing recovery of orbital-class rockets.

- Worldwide, over a dozen firms are working on reusable launch systems.

Limits of Reuse

- Reuse constrained by structural fatigue in engines and tanks.

- Extreme heat, cryogenic propellants, and g-forces cause microfractures.

- Refurbishment costs rise with repeated use.

- SpaceX has reused first stages 30+ times successfully.

India’s Position

- ISRO initiatives:

- Reusable Launch Vehicle (RLV): Winged spacecraft tested for runway landing.

- First-stage recovery using drag and retro-propulsion under development.

- India must adopt disruptive technologies to stay competitive in the global market.

- Future launch vehicles should:

- Minimise number of stages.

- Ensure partial/full recovery.

- Make reusability a core design principle.

Challenges

- High cost of developing reusable systems.

- Need for advanced materials to withstand repeated stress.

- Balancing refurbishment economics with reliability.

Way Forward

- Invest in engine efficiency, propellant density, and compact designs.

- Focus on two-stage systems with recovery options.

- Collaborate with private firms and global partners to accelerate innovation.

- Make reusability central to India’s future launch vehicle strategy.

Conclusion

Reusability is redefining space access by making it sustainable and cost-effective. For India, embracing this disruptive technology is essential to remain competitive in the trillion-dollar global space economy.

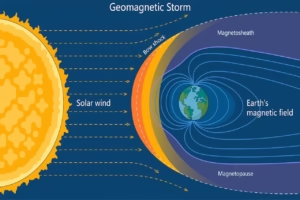

G4 (SEVERE) GEOMAGNETIC STORM

TOPIC: (GS1) GEOGRAPHY: THE HINDU

A G4-level severe geomagnetic storm recently struck Earth, triggered by strong solar activity. It produced spectacular auroras visible across continents and raised concerns about impacts on satellites, communication, and power grids.

What are Geomagnetic Storms?

- A geomagnetic storm is a major disturbance in Earth’s magnetosphere caused by solar wind energy entering Earth’s space environment.

- Triggered by:

- High-speed solar wind sustained for hours.

- Southward-directed solar magnetic field opposing Earth’s field.

- Strongest storms linked to Coronal Mass Ejections (CMEs) – massive plasma bursts from the Sun carrying embedded magnetic fields.

Effects of Geomagnetic Storms

- Auroras: Beautiful light displays near polar regions.

- Ionosphere heating: Distorts long-range radio communication.

- Satellite drag: Expansion of ionosphere alters satellite orbits.

- Electronics damage: Static charge buildup can harm satellite systems.

- Navigation disruption: GPS and global positioning systems affected.

- Power grids: Geomagnetically induced currents (GICs) can damage pipelines and electricity networks.

What is Solar Wind?

- Continuous stream of charged particles (protons & electrons) from the Sun’s corona.

- Travels at speeds of 400–800 km/s in plasma form.

- Carries the Sun’s magnetic field outward.

- When reaching Earth, particles funnel along magnetic field lines toward poles, sparking auroras and storms.

Conclusion

Geomagnetic storms highlight the interconnectedness of solar activity and Earth’s technology systems

C-DOT’S CELL BROADCAST SOLUTION (CBS)

TOPIC: (GS3) SCIENCE AND TECHNOLOGY: THE HINDU

The Centre for Development of Telematics (C-DOT) has received the SKOCH Award 2025 for its Cell Broadcast Solution (CBS), an indigenous disaster alert system that enables real-time communication during emergencies.

About CBS

- Developed by C-DOT as a disaster and emergency alert platform.

- Provides instant dissemination of life-saving information to citizens through mobile networks.

- Works across 2G, 3G, 4G, and 5G technologies.

Key Features

- Automated integration between government alert systems and telecom networks.

- Supports geo-targeted, multi-hazard alerts in 21 Indian languages.

- Designed for varied geographic and demographic conditions.

- Connects multiple agencies:

- India Meteorological Department (weather alerts).

- Central Water Commission (flood warnings).

- Indian National Centre for Ocean Information Services (tsunami alerts).

- Forest Survey of India (forest fire alerts).

- Involves mobile service providers, State Disaster Management Authorities, and NDMA for coordinated response.

Significance

- Enhances disaster preparedness and risk reduction.

- Improves citizen safety by ensuring timely alerts.

- Strengthens India’s compliance with global frameworks:

- UN’s Early Warnings for All programme.

- ITU’s Common Alerting Protocol.

- Promotes self-reliance in critical communication technology.

Conclusion

C-DOT’s CBS is a crucial step in building a resilient disaster management system. By combining indigenous technology with global standards, it ensures faster, reliable, and inclusive emergency communication, safeguarding millions of lives during crises.