Table of Contents

ToggleTRIBAL PROTESTS IN MAHARASHTRA

TOPIC: (GS2) POLITY: THE HINDU

Thousands of tribal farmers from Palghar and Nashik districts marched in January 2026 demanding land rights and implementation of the Forest Rights Act (FRA), 2006.

Background of the Tribal Protests

- Palghar March (Jan 19–22, 2026): Organised by tribal communities to demand recognition of forest rights and livelihood security.

- Nashik March (Jan 25–29, 2026): Highlighted broader concerns about implementation of the Forest Rights Act (FRA, 2006) and access to forest resources.

- The protests reflect the tension between livelihood needs and conservation policies, as well as challenges in FRA implementation (high rejection rates, partial land allocation, digitisation errors).

Demands of Tribals

- Land Rights: Recognition of forest land they have cultivated for generations under FRA, 2006.

- Ownership Titles: Current format lists names under village records, excluding individuals from schemes and loans.

- Irrigation Projects: Construction of small dams and river-linking to divert west-flowing rivers for year-round farming.

- MSP for Crops: Minimum Support Price for crops beyond paddy — maize, soybean, onion, mango, ragi, jowar, bajra, etc.

- Employment: Completion of pending recruitments under PESA Act, 1996 to empower tribal youth.

- Education & Services: Filling teacher vacancies, better schooling, and 24-hour electricity supply.

Concerns with FRA Implementation

- High Rejection Rate: In Maharashtra, over 45% of claims under the Forest Rights Act have been rejected, reflecting procedural and verification challenges.

- Partial Land Allocation: Tribals often receive only a fraction of the land they actually cultivate, limiting livelihood security.

- Village-Level Titles: Records frequently show collective village ownership instead of individual names, reducing personal land rights.

- Conservation vs Rights Tension: Traditional conservation policies often conflict with FRA’s principle of integrating forest dwellers into resource management, creating friction between ecological protection and community rights.

Government’s Position

- Maharashtra has processed 3.8 lakh claims out of 4.09 lakh filed; 2.08 lakh titles distributed, 1.72 lakh rejected, with 28,190 pending.

- CM Devendra Fadnavis assured positive steps to resolve issues.

- Officials admit differences in interpretation of FRA provisions and promise corrective measures.

Forest Rights Act (FRA), 2006

Recognises the rights of forest-dwelling Scheduled Tribes and other traditional forest dwellers over land and resources they have been using for generations.

- Individual Rights: Grants ownership of forest land (up to 4 hectares) to families who have been cultivating it traditionally.

- Community Rights: Provides rights to use, manage, and protect community forest resources (like grazing, fishing, minor forest produce, etc.).

- Empowerment: Strengthens local governance by giving Gram Sabhas the authority to initiate and approve claims.

- Conservation Role: Integrates forest dwellers into conservation and management, balancing livelihood needs with ecological protection.

- Implementation Issues:

- High rejection rates of claims in many States.

- Often only partial land allotment compared to what tribals actually cultivate.

- Records sometimes show collective village ownership instead of individual names.

- Significance: FRA is central to tribal justice, livelihood security, and inclusive development, while also addressing the historic marginalisation of forest communities.

Conclusion

The protests underline that land rights remain central to tribal justice. Effective FRA implementation, irrigation support, and livelihood opportunities are crucial to address decades of exclusion.

WETLANDS AS A NATIONAL PUBLIC GOOD

TOPIC: (GS3) ENVIRONMENT: THE HINDU

World Wetlands Day 2026 was observed on February 2 under the theme “Wetlands and Traditional Knowledge: Celebrating Cultural Heritage”.

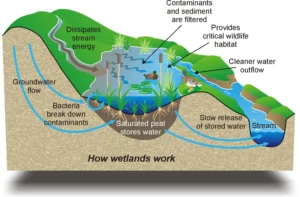

What Are Wetlands?

- Wetlands are areas where water covers the soil or is present near the surface for long periods, creating conditions for special plants, animals, and microorganisms.

Types:

- Freshwater wetlands – lakes, rivers, marshes, ponds.

- Coastal wetlands – mangroves, lagoons, estuaries.

- Man-made wetlands – reservoirs, tanks, rice paddies.

Functions:

- Natural water filters (purify water).

- Flood buffers (absorb excess rainwater).

- Carbon sinks (store carbon, mitigating climate change).

- Biodiversity hotspots (home to migratory birds, fish, amphibians).

India’s Position in Wetlands

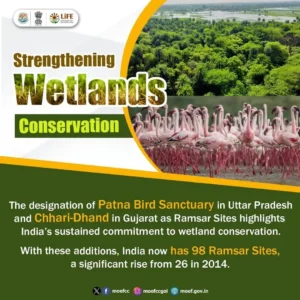

- Global Commitment: India joined the Ramsar Convention in 1982, pledging to conserve and use wetlands wisely.

- Ramsar Sites: As of 2026, India has 98 Ramsar wetlands of international importance, covering diverse ecosystems from Himalayan high-altitude lakes to coastal mangroves.

- Global Standing: India is among the top countries in Ramsar site numbers, reflecting its ecological diversity and conservation efforts.

- Threats: Despite recognition, nearly 40% of wetlands have disappeared in the last three decades due to urbanisation, pollution, and land conversion.

- Recent Additions (2026):

- Patna Bird Sanctuary (Uttar Pradesh) – important for migratory birds.

- Chhari-Dhand (Gujarat) – supports flamingos and other waterfowl.

Traditional Importance

- Tamil Nadu: Ancient irrigation tanks (kulams) supported paddy cultivation.

- Kerala (Wayanad): Kenis (shallow wells) provided drinking water and cultural value.

- Andhra Pradesh (Srikakulam): Wetlands sustained traditional fishing livelihoods.

- Wetlands have historically been ecology + economy + heritage, vital for community wellbeing.

Challenges in India

- Loss of Wetlands: Nearly 40% vanished in 30 years, and half of the remainder show degradation.

- Encroachment & Land Conversion: Wetlands replaced by real estate, roads, and infrastructure.

- Pollution: Sewage, industrial effluents, and agricultural runoff cause eutrophication.

- Coastal Pressures: Sea-level rise, cyclones, and tourism threaten mangroves and lagoons.

- Weak Institutions: State wetland authorities face staff shortages, poor training, and limited funds.

Policy Framework

- Wetlands Rules, 2017: Provide legal basis for identification and management.

- NPCA Guidelines: Push for structured planning and monitoring.

- CRZ Regulations: Protect coastal wetlands.

- Ramsar Sites: India has 98 Ramsar wetlands, offering global recognition and responsibility.

Pragmatic Approaches

- Boundary Notification – Demarcate wetlands with maps, grievance redress, and community participation.

- Wastewater Treatment – Ensure treated inflows; wetlands cannot replace sewage plants.

- Catchment Protection – Restore feeder channels, regulate extraction, and prevent dumping.

- Disaster Risk Reduction – Treat mangroves, floodplains, and mudflats as natural buffers.

- Capacity Building – Launch national training missions for wetland managers in hydrology, ecology, GIS, and law.

Conclusion

Wetlands are vital for India’s ecology, economy, and resilience, yet face severe degradation. Aligning science, policy, and community wisdom is essential to restore them as thriving ecosystems.

SIXTEENTH FINANCE COMMISSION AND FISCAL FEDERALISM

TOPIC: (GS3) ECONOMY: THE HINDU

The Sixteenth Finance Commission (FC-16) has recommended retaining the States’ share in the divisible pool at 41% for 2026–31.

Fiscal Federalism

- Refers to the financial relationship between the Union and the States, ensuring fair distribution of tax revenues and grants so that both levels of government can meet their responsibilities.

- Ensures equity and efficiency: richer States contribute more, poorer States get support. Balances national priorities with local needs.

- Current debates highlight the mismatch between responsibilities and resources, making reforms in fiscal federalism urgent.

- States had demanded a higher share of 50%, citing fiscal stress under the GST regime. The mismatch has forced States to rely heavily on market borrowings.

Key Recommendations

- Vertical Devolution: States’ share in central taxes retained at 41%.

- Horizontal Formula Changes:

- Tax Effort replaced with Contribution to GDP; weight raised from 2.5% (FC-15) to 10%.

- Demographic Performance weight reduced, reflecting India’s demographic dividend phase.

- Population Size weight modestly increased.

- Transfers to States: Projected to rise by 12.2% between FY26 (RE) and FY27 (BE).

- Cesses & Surcharges: FC-16 flagged shrinking divisible pool due to these levies but did not recommend their inclusion.

Vertical and Horizontal Devolution

Vertical Devolution

- Distribution of the net proceeds of Union taxes between the Centre and all States combined.

- Purpose: Ensures States get a fair share of national tax revenue.

- Example:

- The 16th Finance Commission recommended that 41% of the divisible pool of central taxes be devolved to States for 2026–31.

- This is vertical devolution because it defines the overall share of States versus the Centre.

Horizontal Devolution

- Distribution of the States’ share of taxes among individual States.

- Purpose: Ensures equitable distribution based on criteria like population, income, area, and fiscal effort.

- Example:

- Within the 41% share, each State’s portion is decided using a formula.

- The 16th Finance Commission increased the weight of “contribution to GDP” from 2.5% to 10%, reduced demographic performance weight, and modestly raised population size weight.

- This means industrialised States like Tamil Nadu and Maharashtra gain slightly more, while poorer States still receive significant transfers to avoid shocks.

Implications

- Industrialised States Gain Incrementally: Tamil Nadu and Maharashtra argued for higher weightage to GDP contribution (15%), but FC-16 raised it only to 10% from 2.5% earlier.

- Dependence on Centrally Sponsored Schemes (CSS): Total transfers to States are budgeted to rise 12.2% between FY26 (RE) and FY27 (BE). Of this increase, ₹1.2 lakh crore (42%) comes from CSS revenue transfers, not from untied Finance Commission devolutions.

- Fiscal Federalism Tilted Towards Centre: Vertical devolution remains at 41%, unchanged from FC-15, despite States demanding 50%. Effective divisible pool is shrinking due to cesses and surcharges, which are excluded from devolution.

Way Forward

- Gradual Increase in Vertical Devolution: Raise States’ share of the divisible pool from 41% to 45% by 2031. This would expand fiscal space for States, allowing them greater autonomy in development spending.

- Inclusion of Cesses and Surcharges: Currently, cesses and surcharges form nearly 18–20% of gross tax revenues but are excluded from devolution.

- Strengthening State-Level Fiscal Autonomy: This enables alignment of spending with local priorities such as health, education, and infrastructure.

FINANCE COMMISSION

The Finance Commission is a constitutional body created under Article 280 of the Indian Constitution to recommend how tax revenues are shared between the Union and the States.

- The Sixteenth Finance Commission (FC-16), constituted in 2024, is chaired by Dr. Arvind Panagariya and will guide fiscal transfers for the period 2026–31.

Constitutional Provisions of the Finance Commission

- Article 280: Provides for the establishment of a Finance Commission every five years (or earlier if required).

- Composition: A Chairman and four other members appointed by the President of India.

- Functions:

- Recommend distribution of net proceeds of taxes between Centre and States (vertical devolution).

- Determine principles for allocation among States (horizontal devolution).

- Suggest measures to augment State Consolidated Funds for local bodies.

- Advise on grants-in-aid to States under Article 275.

- Address issues of fiscal federalism and equitable resource distribution.

Conclusion

FC-16 acknowledges fiscal stress but stops short of structural reforms. Restoring balance in fiscal federalism requires expanding States’ share and reducing dependence on central schemes.

TAMIL NADU’S INDUSTRIAL STRENGTH AND REFORMS

TOPIC: (GS3) ECONOMY: THE HINDU

The Economic Survey of India 2025–26 highlighted Tamil Nadu’s strong economic growth which recorded 11.19% real growth in 2024–25, making it the fastest-growing State economy in India.

Economic Performance

- Tamil Nadu is India’s second-largest State economy and a major contributor to national growth.

- Manufacturing growth: 14.74% real growth, over three times the all-India average (4.5%).

- Secondary sector growth: 13.43%, driving overall expansion.

- Exports: Merchandise exports doubled from $26.15 billion (2020–21) to $52.07 billion (2024–25).

- Inflation: Headline CPI declined to 2.45% in 2025–26.

Industrial Diversity

- Legacy industries: textiles, leather, cement (85% concentrated in Tamil Nadu).

- Emerging clusters: automobiles, auto components, electronics (Sriperumbudur).

- Approved for Medical Devices Park with ₹100 crore support.

- Contributes 15% of India’s manufacturing employment, highest among States.

Reforms and Ease of Doing Business

- Business Reforms Action Plan (BRAP) 2024: single-window clearances, digitised approvals, land reforms.

- Promotes solar parks, decarbonisation plans, and energy efficiency programmes.

- Faster project execution with stronger environmental compliance.

Climate Action and Pollution Control

- TN Pollution Control Board: monitors effluent treatment, supports common treatment plants.

- Green Hydrogen Hub: V.O. Chidambaranar Port designated as one of three national hubs.

- Blue Economy Project: addresses coastal vulnerabilities across 14 districts.

- Climate Resilient Villages: model for grassroots climate adaptation.

Urban Development and Education

- Chennai: cited as a global urban agglomeration with best practices in civic behaviour.

- Parking Policy 2025: recognised nationally.

- Higher Education: 17 institutions in NIRF Top 100 (2025), highest among States.

- Women’s Empowerment: Thozhi Hostels model for workforce participation.

- Skill Voucher Scheme (2024): supports disadvantaged students.

Conclusion

Tamil Nadu’s success lies in combining industrial expansion with social equity and sustainability. Its leadership in manufacturing, education, and climate initiatives makes it a key driver of India’s Vision 2047.

BUDGET 2026–27 – VISIBLE PROGRESS, INVISIBLE EXCLUSION

TOPIC: (GS3) ECONOMY: THE HINDU

The Union Budget 2026–27 emphasises fiscal prudence with a 4.3% fiscal deficit target and record ₹12.2 lakh crore capital expenditure.

Fiscal Strategy

- Shift in Approach: India has moved from pandemic-era stimulus spending to a borrowing-heavy growth model.

- Capex as Core Policy: Capital expenditure is now the structural backbone of fiscal policy, not just a temporary counter-cyclical tool.

- Rising Share of Capex: Share of capital expenditure in total spending increased from 12% in 2020–21 to 22% in 2025–26.

- Objective: To crowd-in private investment, enhance productivity, and provide stronger support to MSMEs.

Employment Disconnect

- Weak Labour Absorption: Despite record investment, job creation has not kept pace.

- Youth NEET Rate: Around 23–25% of youth (ages 15–29) are not in education, employment, or training — higher than many peer economies.

- Construction Sector: Employment elasticity fell from 0.59 (2011–20) to 0.42 (2021–24), even though infrastructure spending was at record levels.

- Agriculture Sector: Employment elasticity rose from 0.04 to 1.51, showing that more workers are being pushed back into low-productivity farming due to distress.

Structural Concerns

- Public investment favours capital-intensive sectors, widening the gap between productivity and wages.

- Efficiency gains captured as profits, not transmitted as labour income.

- Industrial structure skewed: Majority of factories employ <100 workers, contributing modestly to output. Large firms dominate value creation but remain labour-light.

- MSMEs struggle to scale and compete, limiting job creation.

Implications

- India’s growth model is GDP-driven but labour-excluding.

- Employment treated as a by-product of growth, not a co-equal objective.

- Formal skills, urban location, and automation compatibility determine inclusion.

- Informal work, self-employment, and agriculture absorb those excluded.

Conclusion

India’s fiscal path signals robust infrastructure-led progress, yet labour absorption remains weak. Without structural reforms linking capex to jobs, growth risks becoming exclusionary.

FINANCE COMMISSION GRANTS TO URBAN LOCAL GOVERNMENTS

TOPIC: (GS3) ECONOMY: THE HINDU

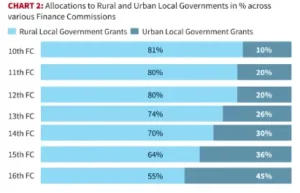

The 16th Finance Commission (2026–31) has recommended a 230% increase record allocation to Urban Local Governments (ULGs).

16th Finance Commission

- Focus on Urbanisation and Local Governance: ₹3.5 lakh crore allocated to ULGs for 2026–31, marking a 230% increase over the ₹1.5 lakh crore given by the 15th Finance Commission.

- Higher Share for ULGs: Share of local government grants to ULGs raised from 36% (FC-15) to 45% (FC-16). This shift strengthens financial autonomy of cities and towns.

- Urbanisation Premium Grant: ₹10,000 crore earmarked to incentivise rural-to-urban transition. Designed to support smaller towns in managing migration and infrastructure needs.

- Scale of Support: The ₹3.5 lakh crore allocation matches the Centre’s spending on centrally sponsored urban schemes over the last 13 years combined. Indicates a policy shift towards decentralised urban development.

State-Level Trends

- Kerala: Recorded the highest increase in allocation, with urban grants rising by over 400%.

- Himachal Pradesh: Experienced a near 50% decline in urban grants compared to earlier allocations.

- Other States: Received varied allocations depending on urbanisation levels, fiscal needs, and governance capacity.

Grant Structure

- Basic Grants (≈60% of total):

- Tied Grants: Specifically earmarked for essential services such as water supply and sanitation.

- Untied Grants: Flexible funds for local priorities, excluding salaries and administrative expenses.

- Purpose: Designed to strengthen first-mile infrastructure and improve service delivery in smaller towns and cities.

Implications of FC-16 Recommendations

- Enhanced Financial Autonomy: With a record ₹3.5 lakh crore allocation to Urban Local Governments (ULGs), States and cities gain more fiscal space. This enables better planning and execution of local development projects.

- Support for Urban Infrastructure: Around 60% of grants are basic grants, ensuring direct investment in essential services.

- Decentralised Governance: By raising ULGs’ share of local government grants from 36% to 45%, FC-16 empowers local institutions.

- This strengthens grassroots governance, allowing towns and cities to address location-specific needs more effectively.

Conclusion

The tripling of urban grants empowers local governments to lead India’s urbanisation with better infrastructure and services. It’s a step toward more inclusive and decentralised development.

RURAL WOMEN ENTREPRENEURSHIP

TOPIC: (GS3) ECONOMY: THE HINDU

Recent developments, such as the Kudumbashree kiosk in Kerala marketing tribal forest produce, highlight the evolving role of rural women’s entrepreneurship and the need for stronger institutional support.

Background

- DAY-NRLM, launched by the Ministry of Rural Development, has mobilised 10 crore households into 91 lakh Self-Help Groups (SHGs).

- These SHGs are federated into 5.35 lakh Village Organisations (VOs) and 33,558 Cluster-Level Federations (CLFs).

- SHGs have accessed ₹11 lakh crore credit from banks, with NPAs at only 1.7%, showing strong repayment discipline.

- Over 2 crore “Lakhpati Didis” (earning more than ₹1 lakh annually) demonstrate the program’s success in boosting incomes.

Current Achievements

- Enhanced economic empowerment through credit mobilisation and entrepreneurship.

- Strengthened political empowerment, with women influencing DBT-linked welfare schemes across States.

- Example: Bihar’s Mukhyamantri Mahila Rozgar Yojana transferred ₹10,000 each to over 1 crore women.

Challenges

- CLFs Subservience: Many CLFs are seen as dependent on government officials, limiting community ownership.

- Idle Funds: Around ₹56.69 lakh crore given as capitalisation support remain underutilised, raising concerns of misuse.

- Credit Limitations: SHG members face difficulty scaling enterprises due to lack of individual credit history and limited bank linkage loans.

- Fragmented Schemes: Livelihood interventions often operate in silos, reducing overall impact.

Way Forward

- Strengthen CLFs: Revitalise them as community-owned institutions, free from excessive government interference.

- Financial Innovation: Move beyond debt financing to equity, venture capital, and blended finance; partner with SIDBI, NBFCs, and neo-banks.

- Credit Access: Develop systems for CIBIL scores of individual SHG members to enable larger loans.

- Convergence: Institutionalise coordination through a Convergence Cell at NITI Aayog to avoid duplication and ensure efficient resource use.

- Marketing Support: Create a dedicated marketing vertical at the national level; professional hubs at State/UT level for branding and logistics.

Conclusion

The next phase of DAY-NRLM must focus on strengthening CLFs, diversifying financing models, and building robust marketing systems. With these reforms, rural women’s entrepreneurship can move from subsistence to sustainable growth, deepening both economic and social empowerment.

ADAPTIVE TESTING

TOPIC: (GS2) POLITY: THE HINDU

The IIT Council has proposed a shift to adaptive testing for JEE Advanced starting 2026, aiming to reduce exam stress and improve fairness by tailoring question difficulty to each candidate’s performance.

What Is Adaptive Testing?

- Adaptive testing uses Item Response Theory (IRT) to dynamically adjust question difficulty based on the candidate’s previous answers.

- The test begins with a medium-level question. If answered correctly, the next question is harder; if wrong, it becomes easier.

- Each candidate sees a different set of questions, but all are evaluated on a common scale.

- This method aims to assess conceptual understanding rather than rote memorization or test-cracking strategies.

Why IIT Council Recommended It

- To make JEE Advanced less stressful and more scientific.

- To reduce the influence of coaching culture and promote deeper learning.

- To align with global best practices (used in GRE, GMAT for over 25 years).

- To improve assessment precision with fewer but better-targeted questions.

How Adaptive Testing Can Be Implemented

- Two-Year Transition (2026–2028): Begin with free adaptive mock tests in 2026 to familiarise students. Gradually calibrate question banks and refine the student interface.

- Develop Large, Secure Item Banks: Build a repository of questions covering the entire syllabus. Ensure strict pre-testing and protection against leakage.

- Transparent Scoring and Grievance Systems: Publish clear documentation on how scores are calculated. Establish grievance redress mechanisms for students to challenge anomalies.

Legal and Technical Challenges

- Article 14 concerns: Different question sets may be seen as unequal treatment unless transparency is ensured.

- Algorithm bias risks: Lack of clarity in scoring models could invite equity-related litigation.

- Infrastructure gaps: Tier-3 cities need reliable internet, data centers, and proctoring systems.

- Trust deficit: Parents and students may struggle to accept that fewer harder questions can yield higher scores.

Way Forward

- Phased Transition: Begin with mock adaptive tests in 2026 to familiarise students and gradually move to full implementation by 2028.

- Transparency and Trust Building: Publish clear scoring models, conduct equity audits, and establish grievance redress systems to ensure fairness and acceptance.

- Strengthen Infrastructure: Invest in reliable digital platforms, data security, and proctoring systems, especially in tier-2 and tier-3 cities, to avoid technical glitches.

Conclusion:

Adaptive testing for JEE Advanced aims to make assessments more precise and less stressful, If implemented with transparency and strong infrastructure, it can balance fairness with innovation, marking a significant reform in India’s exam system.

TWO NEW WETLANDS

TOPIC: (GS3) ENVIRONMENT: THE HINDU

Why in News?

Union Minister for Environment, Forest and Climate Change announced the addition of two new wetlands — Patna Bird Sanctuary in Uttar Pradesh and Chhari-Dhand in Gujarat —

1. Patna Bird Sanctuary (Uttar Pradesh)

Location

- Situated in Etah district, Uttar Pradesh near the town of Jalesar.

- Covers about 109 hectares and is one of the smaller yet ecologically significant bird sanctuaries in the state.

Key Ecological Features

- Diverse Habitats: Includes freshwater marshes, woodlands and grasslands forming a mosaic of ecosystems.

- Biodiversity Hub:

- Supports a wide range of waterbirds and resident birds during migration seasons.

- 178 bird species and 252 plant species have been recorded here.

- Also sustains other wildlife like nilgai, jackals and wild cats in surrounding landscapes.

- Designation and Recognition: It has been recognised as an Important Bird and Biodiversity Area (IBA) by BirdLife International for its role in avian conservation.

2. Chhari-Dhand Wetland (Gujarat)

Location

- Located in Kutch district, Gujarat, between the Banni grasslands and salt flats.

- It is a seasonal saline wetland — receiving water mainly during monsoons and drying partly in other seasons.

Key Ecological Features

- Bird Migration Hotspot:

- Acts as a major wintering and stopover site for waterfowl and migratory birds entering India via the western flyway.

- Hosts tens of thousands of birds annually, including common cranes, and supports critically endangered and vulnerable species like sociable lapwing and common pochard.

- Rich Fauna:

- Terrestrial species spotted in and around the wetland include chinkara, desert fox, caracal, wolves and desert cats.

- Ecosystem Value:

- The wetland links grassland–desert–wetland interfaces, supporting a complex web of aquatic and terrestrial life.

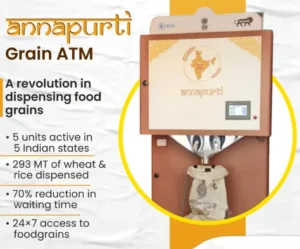

GRAIN ATM

TOPIC: (GS2) POLITY: THE HINDU

Why in News?

The Bihar government has approved installation of the first three Grain ATM machines in Patna as a pilot project to modernize food grain distribution.

Key Features of Grain ATM

- High dispensing speed – can release up to 50 kg grain in about 5 minutes.

- 24×7 availability – functions like a bank ATM, reducing crowding at ration shops.

- Solar power compatible – can operate in areas with limited electricity.

- Digital integration – connected to PDS databases through internet.

- Accurate measurement – reduces chances of weighing fraud.

- User-friendly interface – beneficiaries select grain type and quantity on screen.

Working Mechanism

- Beneficiary uses a ration card or Grain ATM card at the machine.

- The system is linked with Aadhaar for biometric authentication.

- After identity verification, the person chooses grain category and amount within their entitlement.

- Machine dispenses grains automatically in measured quantity.

- Transaction data updates instantly in the PDS records.

- A printed slip serves as proof of collection.

Schemes / Bodies Involved

- Public Distribution System (PDS) – ensures subsidised food grains.

- National Food Security Act (NFSA), 2013 – legal backing for food entitlements.

- World Food Programme – technical support.

- Food Corporation of India (FCI) – procurement and supply chain role.