Table of Contents

ToggleMISUSE OF MPLADS FUNDS

TOPIC: (GS2) POLITY: THE HINDU

A recent controversy over alleged misuse of MPLADS (Members of Parliament Local Area Development Scheme) funds by some MPs has reignited debate on whether the scheme should be scrapped or strengthened.

MPLADS Scheme

- MPLADS was launched in 1993 as a Central Sector Scheme, fully funded by the Government of India.

- It allows MPs to recommend developmental projects worth ₹5 crore annually in their constituencies, focusing on durable community assets like roads, schools, and water facilities.

- The scheme is monitored through the MPLADS dashboard, which tracks allocations and expenditures.

The Current Controversy

- Allegations surfaced that three MPs from Rajasthan allocated funds for projects in Kaithal district, Haryana, instead of their constituencies.

- Critics argued this violated the scheme’s intent, while the MPs cited 2023 guidelines, which permit up to ₹50 lakh annually outside the constituency/State, and up to ₹1 crore in case of severe calamities.

- The debate reflects broader concerns about political motivations and cross-State allocations.

Utilisation Trends

- 18th Lok Sabha (ongoing): ₹5,486 crore allocated; ₹1,453 crore spent so far.

- 17th Lok Sabha (2019–24): ₹4,837 crore allocated; ₹3,639 crore spent; 41,143 projects completed out of 96,211 recommended.

- 16th Lok Sabha (2014–19): Only 8.7% funds unused.

- 15th Lok Sabha (2009–14): 3.47% funds unused.

- 14th Lok Sabha (2004–09): Less than 1% funds unused.

- Data shows that despite some underutilisation (especially during COVID years), the scheme has largely been effective.

Examples of Effective Use

- Sant Balbir Singh Seechewal (Punjab): Spent over ₹9.34 crore to tackle water scarcity.

- Iqra Choudhary (Kairana): Maintained a transparent MPLADS profile with geotagged images.

- Tejasvi Surya (Bengaluru South): Utilised ₹19.36 crore, emerging as a top performer.

- Abhishek Banerjee (Diamond Harbour): Completed 173 projects, spending ₹6.13 crore.

Arguments Against Scrapping

- Utilisation Trends Remain Strong: While some misuse and incomplete projects exist, overall data shows high utilisation rates, indicating the scheme’s effectiveness in delivering development.

- Localised Development Impact: MPLADS directly addresses constituency-level needs, ensuring that funds are channelled into projects that improve everyday infrastructure and services.

- Accountability of MPs: By linking expenditure to constituency development, the scheme enhances the responsibility of MPs toward their voters.

- Loss of Flexibility if Scrapped: Discontinuation would remove a crucial funding mechanism for small-scale but high-impact projects that often do not get covered under larger government schemes.

Way Forward

- Capacity Building: Conduct structured workshops to train MPs and their teams on planning, prioritising, and effectively utilising MPLADS funds.

- Transparency Mechanisms: Promote geotagging of projects, real-time dashboards, and citizen-accessible records to strengthen public trust and reduce misuse.

- Robust Monitoring: Institutionalise stronger social audits and statutory audits to ensure accountability, detect irregularities early, and improve compliance with guidelines.

Conclusion

The MPLADS scheme has proven valuable in creating community assets and addressing local needs. While misuse cases exist, they are exceptions rather than the norm. Strengthening transparency and utilisation mechanisms is a better path than discontinuation.

INDIA’S NEXT INDUSTRIAL SHIFT

TOPIC: (GS3) ECONOMY: THE HINDU

India is preparing for a major industrial transition where electricity (electrons) will increasingly replace fossil fuels (molecules) in factories and industries.

Background

- For over a century, industries worldwide have relied on molecules — coal, oil, and gas — for energy.

- The emerging global trend is a shift toward electrons, i.e., clean and reliable electricity delivered through grids.

- This transition is crucial for reducing emissions, improving efficiency, and strengthening industrial competitiveness.

- Experts highlight that without rapid electrification, India risks losing competitiveness in global supply chains, especially under carbon-sensitive trade regimes like the EU’s CBAM.

Importance of Industrial Electrification

- Efficiency Advantage: Electric motors convert 90% of energy into useful work, compared to 35% in combustion engines.

- Automation & Control: Electrification enables better process control, digitalisation, and easier decarbonisation.

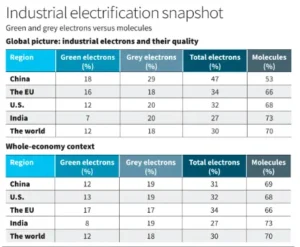

- Global Benchmark:

- China: Nearly 50% of industrial energy from electricity, with a high share of green electrons.

- India: Only 25% industrial energy from electricity; green electrons just 7–8% of final energy.

- U.S. & EU: Around 30–34% economy-wide electrification.

China’s Strategy vs India’s Position

- China’s Approach: Massive investment in grids, ultra-high-voltage transmission, and storage since 2010.

- India’s Status: Doubled grid capacity in a decade, leading in solar additions. unreliable power quality, and policy focus on generation rather than industrial electrification.

Roadmap for India

- Steel Sector: Expand EAF share beyond current 30%, improve scrap collection, and incentivise renewable-linked furnaces.

- Cement Sector: Pilot electrified kilns, scale waste-heat recovery, and prepare CCUS hubs.

- MSMEs: Replace coal boilers and diesel gensets with electric boilers and induction furnaces. Provide concessional finance and pooled renewable power purchase agreements.

- Digitalisation: Embed advanced controls in industrial clusters for efficiency and carbon data transparency.

Strategic Importance

- Competitiveness: Global buyers demand low-carbon supply chains; green electrons decide contract outcomes.

- Energy Security: Reduces dependence on imported oil and gas.

- Sovereignty: Industry can locate based on skills and logistics rather than fuel availability.

Conclusion

India must launch a National Mission on Industrial Electrification, raise grid investments, and mandate electrification in new industrial parks. The next industrial revolution will be powered by electrons, not molecules, and India must act decisively to stay competitive.

AI’s NEXT INVESTMENT CYCLE

TOPIC: (GS3) SCIENCE AND TECHNOLOGY: THE HINDU

The global AI sector is moving from costly infrastructure investments toward application-driven growth, where real demand and profitability are emerging.

Background

- For years, AI investment was concentrated on infrastructure — GPUs, data centres, and large models.

- In 2025, nearly $320 billion was spent on infrastructure, but foundation model firms still struggle with low margins and high inference costs.

- Example: OpenAI earned $13 billion revenue but reported $5 billion losses in 2024, showing unsustainable economics.

- The new focus is on applications that deliver direct business value.

Rise of AI Applications

- In 2025, spending on AI applications reached $19 billion, over 6% of the global software market.

- At least 10 AI products now generate more than $1 billion annually, while 50 products earn above $100 million.

- Meta’s $2 billion acquisition of Manus (Singapore startup) in 2025 highlights investor interest in practical AI solutions.

- Private equity deals in AI applications rose 65% year-on-year, with M&A values up 242%.

Where Value Lies

- Departmental AI: Coding tools dominate, contributing $4 billion of the $7.3 billion departmental AI market.

- Over 50% of developers use AI coding tools daily; in top firms, usage rises to 65%.

- Companies like Anthropic gained market share by focusing on coding applications, rising to 40% of enterprise LLM spending, while OpenAI’s share fell to 27%.

- Profits are increasingly captured by firms offering complete solutions, not just raw computing power.

Strategic Importance

- Competitiveness: Applications embedded in workflows (healthcare, law, finance, manufacturing) create lasting value.

- Profitability: Generative AI achieved 34% contribution margin in 2025, projected to reach 67% by 2028 as costs decline.

- Market Dynamics: Applications drive infrastructure adoption, reversing the earlier trend.

Policy Concerns

- Competition: Foundation model providers entering applications may disadvantage smaller firms.

- Copyright & Privacy: Training data sources and personal information access raise legal challenges.

- Regulation: Policymakers should allow experimentation but ensure fair competition, preventing anti-competitive acquisitions and harmful acqui-hires.

What is AI and how it works

Artificial Intelligence (AI) means machines or computer systems that can perform tasks which normally require human intelligence, like learning, reasoning, problem-solving, or understanding language.

How AI Works

- Data Input: AI learns from large amounts of information (text, images, numbers, etc.).

- Patterns: It finds patterns and relationships in that data.

- Learning: Using algorithms, AI improves its performance over time (this is called machine learning).

- Decision Making: Based on what it has learned, AI makes predictions or decisions (e.g., suggesting movies, detecting fraud).

- Automation: AI can perform repetitive tasks faster and more accurately than humans.

- Adaptability: Advanced AI systems adjust to new information and improve without being reprogrammed.

Conclusion

The next AI growth cycle will be defined by applications, not infrastructure. India and other economies must focus on sector-specific AI solutions that integrate deeply into workflows, ensuring both profitability and competitiveness in the global digital economy.

INDIA–U.S. TRADE DEAL

TOPIC: (GS3) ECONOMY: THE HINDU

India and the United States have announced a new trade deal that reduces U.S. tariffs on Indian goods from 50% to 18%, bringing relief to several industries.

Background

- The deal was announced jointly by Prime Minister Narendra Modi and U.S. President Donald Trump via social media, marking a departure from India’s usual formal channels.

- Commerce Minister Piyush Goyal later confirmed that sensitive sectors such as agriculture and dairy would be excluded from concessions.

- The U.S. agreed to reduce its reciprocal tariffs from 25% to 18% and remove the additional 25% penalty tariffs linked to India’s purchase of Russian oil.

Key Features of the Deal

- Tariff Reduction: Major relief for Indian exports, especially in labour-intensive sectors like textiles, footwear, leather, apparel, and engineering goods.

- Exclusion of Sensitive Sectors: Agriculture and dairy remain protected, ensuring domestic interests are not compromised.

- Ambiguity in Commitments: No clarity yet on India’s concessions in terms of investments, purchase orders, or oil imports.

Concerns and Challenges

- Implementation Timeline: While the U.S. President claimed tariffs would be cut “immediately,” India’s Commerce Minister said details would be shared “soon.”

- Russian Oil Issue: Reports suggest India may reduce or stop Russian oil imports, which currently account for nearly one-third of India’s crude supply. This could affect India’s energy security and relations with Russia.

- Alternative Sources: Buying Venezuelan crude poses refining challenges, while increasing U.S. oil imports may raise costs.

- Competitiveness Gap: Even after tariff cuts, Indian exports may face slightly higher duties compared to South-East Asian competitors with Most-Favoured Nation (MFN) status.

Economic Impact

- Positive Market Reaction: Stock markets and the rupee strengthened after the announcement.

- Boost to Exports: Labour-intensive industries, already benefiting from the upcoming India–EU trade deal, stand to gain further competitiveness in the U.S. market.

- Budgetary Support: Targeted measures in the Union Budget 2026 are expected to help bridge the competitiveness gap.

India–U.S. Trade (FY 2024–25)

- Total trade: $131.8 billion (U.S. is India’s largest trading partner).

- India’s exports to U.S.: $86.51 billion (↑ 11.6% from previous year).

- India’s imports from U.S.: $45.33 billion (↑ 7.4% from previous year).

- Trade surplus for India: $41 billion.

- Key export sectors: Textiles, engineering goods, pharma, IT services.

- Key imports from U.S.: Oil, aircraft parts, electronics, defence equipment.

Why Services Are Not Included in Trade Deficit

- Goods vs Services: Trade deficit is usually calculated only on merchandise (goods), since they are tangible and tracked at ports/customs.

- Measurement Difficulty: Services (like IT, finance, tourism) are harder to quantify consistently across countries.

- Political Narrative: Governments often highlight goods deficit because it is more visible and easier to link with jobs/manufacturing.

- Reality Check: India exports more goods to the U.S. than it imports, creating a surplus. But if services were included, the U.S. would offset part of this gap, which is why services are often excluded from the deficit calculation.

Conclusion

The India–U.S. trade deal marks a significant step toward easing tariff burdens and boosting exports. Yet, unresolved issues around oil imports, competitiveness, and India’s concessions highlight the need for transparent communication and parliamentary debate before full implementation.

16TH FINANCE COMMISSION AND DEBATE ON STATES’ SHARE

TOPIC: (GS3) ECONOMY: THE HINDU

The 16th Finance Commission (FC) has retained the States’ share in vertical devolution at 41%, despite a rare consensus among States demanding an increase.

Background

- The Finance Commission recommends how tax revenues are shared between the Centre and States.

- The 16th FC kept the vertical devolution rate at 41%, the same as the 15th FC.

- However, the divisible pool excludes cesses, surcharges, and collection costs, which are rising sharply, reducing the effective share available to States.

Shrinking Divisible Pool

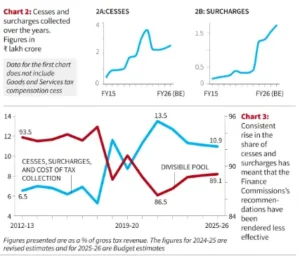

- Between 2013–2019, for every ₹100 collected, ₹93–95 came from shareable taxes; only ₹5–7 from cesses/surcharges.

- By 2021–22, shareable taxes fell to ₹86.5, while cesses/surcharges rose to ₹13.5.

- In FY26, projections show ₹89 from taxes and ₹11 from cesses/surcharges.

- Collections of cesses rose from ₹44,688 crore (FY15) to ₹3.52 lakh crore (FY22); surcharges rose from ₹15,702 crore (FY15) to ₹1.72 lakh crore (FY26 expected).

- This means the divisible pool’s share in gross tax revenue has stayed below 90% for six consecutive years, compared to consistently above 93% earlier.

States’ Demands

- 18 States including Odisha, Kerala, Tamil Nadu, Gujarat, and Haryana demanded an increase in vertical devolution to 50% of the divisible pool.

- Several other States sought a moderate rise to 45–48%, citing rising fiscal pressures and shrinking revenues.

- Their demand was based on the fact that the share of divisible pool in gross tax revenue has fallen below 90% for six consecutive years, compared to consistently above 93% between FY13–FY18, due to the Centre’s growing reliance on cesses and surcharges.

Centre’s Position

- The Centre argued for “moderation in tax devolution”, opposing any increase beyond the current 41%.

- Cesses and surcharges are required for emergencies such as war, famine, or pandemics.

- Defence and infrastructure spending needs have expanded, requiring greater central resources.

- As per Finance Ministry data, collections from cesses rose from ₹44,688 crore in FY15 to ₹3.52 lakh crore in FY22, while surcharges increased from ₹15,702 crore in FY15 to ₹1.72 lakh crore (FY26 expected).

Commission’s Reasoning

- The Commission said putting a fixed limit on cesses and surcharges would be risky, though depending on them for too long is not good.

- It stated that States already have enough funds to carry out their constitutional duties.

- As a way forward, it suggested that the Centre should gradually move back to collecting more regular taxes instead of relying heavily on cesses and surcharges, so that the shareable pool of revenue becomes larger.

Key Concerns Raised

- Constitutional Intent: Did the framers anticipate such a disproportionate rise in non-shareable revenues?

- Mediator Role: By refusing to cap cesses, has the FC left States without safeguards against shrinking revenues?

- Efficiency Claim: The Centre’s claim of infrastructure efficiency overlooks the fact that high-performing States lose out under current distribution.

- Consensus Ignored: Nearly all States, cutting across political lines, demanded a larger share — yet the FC maintained status quo.

Conclusion

The real issue is not just the 41% rate but the shrinking divisible pool due to rising cesses and surcharges. Strengthening fiscal federalism requires expanding shareable revenues and balancing national priorities with State needs.

SPACE SECTOR IN UNION BUDGET 2026–27

TOPIC: (GS3) SCIENCE AND TECHNOLOGY: THE HINDU

The Union Budget 2026–27 has allocated higher funds for India’s space programme, signalling recovery from the pandemic slump.

Background

- India’s space budget has grown by 182% since 2012–13, with rapid expansion between 2014–19.

- Pandemic years slowed spending; the 2019–20 peak of ₹13,017 crore was difficult to surpass.

- The 2026–27 allocation is 5.3% higher than pre-pandemic levels, showing consolidation.

- Including NewSpace India Ltd. (NSIL) resources, total ecosystem spending is around ₹15,000 crore.

Budget Highlights

- Focus remains on ISRO’s programmes (e.g., Gaganyaan, planetary missions).

- Administrative support continues for IN-SPACe, the nodal body for private sector promotion.

- No new fiscal incentives for private space firms were announced.

Structural Reform Demands Ignored

- Production Linked Incentive (PLI) scheme for space-grade components was requested but not included.

- GST rationalisation for satellite launches was overlooked; current regime imposes hidden 18% tax burden on manufacturers.

- No recognition of the sector as critical infrastructure, which would have enabled cheaper long-term loans.

- Lack of tax holidays or R&D credits to bridge the “Death Valley” between prototype development and commercialisation.

Industry Concerns

- Private firms remain dependent on ISRO, often acting as secondary suppliers rather than innovators.

- High borrowing costs (10–12%) compared to global competitors reduce competitiveness.

- Without liquidity support, disruptive technologies like reusable rockets or satellite IoT may not emerge in India.

- Risk of brain drain as talent may migrate to countries with better financial ecosystems.

Previous Initiatives

- In 2024–25, a ₹1,000 crore Venture Capital fund was announced for space start-ups.

- Only ₹150 crore was earmarked for 2025–26, seen as insufficient relative to industry needs.

- While equity support exists, fiscal reforms like GST relief and infrastructure status remain absent.

Conclusion

The Budget stabilises India’s state-led space programme, ensuring ISRO’s missions proceed smoothly. Yet, by neglecting structural reforms such as PLI, GST rationalisation, infrastructure status, and R&D incentives, the government risks slowing private sector growth.

DEFENCE BUDGET 2026–27 AND RISE IN CAPITAL SPENDING

TOPIC: (GS3) SEQURITY: THE HINDU

The Union Budget 2026–27 has allocated a record ₹7.84 lakh crore for defence, with a sharp rise in capital outlay to strengthen military modernisation and domestic defence industry under the Aatmanirbhar Bharat initiative.

Background

- India’s defence budget has long faced the “guns vs butter” dilemma, balancing salaries and pensions with modernisation needs.

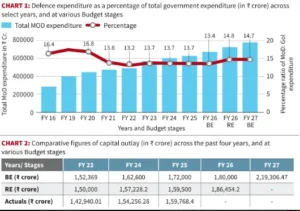

- The FY27 allocation of ₹7,84,678 crore marks the highest-ever defence spending, accounting for 14.7% of total government expenditure.

- This stabilises defence share compared to lean years (FY21–22) when it fell to 13.2%.

Capital Outlay Trends

- Capital outlay (funds for modernisation and big-ticket purchases) has risen to 27.9% of the defence budget, up from 24.9% in FY23.

- In absolute terms, capital spending is ₹2,19,306 crore, a jump of nearly ₹40,000 crore from FY26.

- This rise is significant as earlier trends showed lower revised estimates compared to budget estimates, but FY26–27 reflects higher demand at the RE stage.

Reasons for Increase

- Post-Operation Sindoor Needs: The 2025 conflict exposed shortages in precision-guided munitions and drones, requiring replenishment of war reserves.

- Institutionalised Emergency Procurement: Fast-track acquisitions, once ad hoc, are now becoming standard for critical technologies.

- Committed Liabilities: Payments for past contracts (e.g., Rafale jets, S-400 systems) consume large portions of capex. Higher allocation ensures funds for new projects like Advanced Medium Light Aircraft and Project 75I submarines.

Composition of Defence Spending

- Pensions: Share reduced to 21.8% in FY27, down from 26% in FY20.

- Salaries: Moderated to 22.4%, compared to 30% in FY20.

- Decline attributed to reforms like the Agnipath scheme, which caps revenue expenditure.

- Nearly 75% of capital acquisition budget earmarked for domestic industry, boosting Aatmanirbhar Bharat.

Challenges Ahead

- Absorption Capacity: Defence PSUs and private firms must deliver on time to meet operational needs.

- Buy Indian-IDDM Route: Promotes indigenous design and manufacturing, but tight delivery timelines remain critical.

- Industry Readiness: Heavy allocation reflects confidence in India’s defence industrial base, but execution will determine success.

Conclusion

By prioritising domestic industry and institutionalising emergency procurement, India aims to strengthen its military preparedness and reduce dependence on imports, though timely delivery and industry capacity remain key challenges.

SFDR MISSILE TECHNOLOGY

TOPIC: (GS3) SEQURITY: THE HINDU

India’s Defence Research and Development Organisation (DRDO) has successfully tested the Solid Fuel Ducted Ramjet (SFDR) technology off the Odisha coast.

Background

- The test was conducted at the Integrated Test Range, Chandipur at 10:45 a.m.

- SFDR technology is crucial for developing long-range air-to-air missiles, enhancing India’s aerial combat strength.

- Defence Minister Rajnath Singh hailed the achievement as a milestone in missile development.

What is SFDR Technology?

- Solid Fuel Ducted Ramjet (SFDR) is a propulsion system that allows missiles to maintain high speeds over long ranges.

- Unlike conventional rocket motors, SFDR provides sustained thrust, making missiles more effective against fast-moving aerial targets.

- It offers a decisive tactical edge in modern warfare.

Strategic Importance

- Places India in an elite group of nations with SFDR capability.

- Strengthens India’s self-reliance in defence technology under the Aatmanirbhar Bharat initiative.

- Enhances preparedness for two-front challenges and boosts deterrence against adversaries.

Conclusion

The successful SFDR test marks a major leap in India’s missile programme, ensuring stronger air defence and advancing indigenous technological capabilities.

DEATH PENALTY TRENDS IN INDIA

TOPIC: (GS2) POLITY: THE HINDU

A recent report by Square Circle Clinic, NALSAR University of Law shows that the Supreme Court has not upheld a single death sentence in the past three years, raising concerns about wrongful convictions and procedural lapses in lower courts.

Background

- The Members of Parliament Local Area Development Scheme (MPLADS) is not relevant here; focus is on death penalty trends.

- Between 2016–2025, Sessions Courts imposed 1,310 death sentences.

- In 2025 alone, 128 individuals were sentenced to death at the trial court level.

- The Supreme Court acquitted 10 death row prisoners in 2025, the highest in a decade.

High Rate of Acquittals

- Of 1,310 death sentences, 842 were reviewed by High Courts.

- Only 70 (8.3%) confirmed.

- 285 acquitted.

- 411 commuted to life imprisonment.

- The Supreme Court has been even more cautious:

- No death penalty confirmed in the last three years.

- Of 37 cases reviewed, 15 acquittals and 14 commutations.

- This reflects judicial scepticism about trial court convictions.

Procedural Concerns

- As of Dec 2025, 574 prisoners (550 men, 24 women) were on death row.

- Average time before acquittal: over five years, with some prisoners waiting nearly a decade.

- 95% of death sentences in 2025 were imposed without following Supreme Court guidelines (psychological evaluation, prison conduct reports, mitigation hearings).

- Sentencing often occurred within days of conviction, limiting defence opportunities.

Emerging Trends

- Growing preference for life imprisonment without remission as an alternative to capital punishment.

- Reflects a shift toward humane sentencing practices and concerns about fairness in death penalty trials.

Conclusion

The report highlights systemic issues in India’s death penalty regime: errors at trial courts, lack of procedural safeguards, and high acquittal rates at appellate levels. The Supreme Court’s reluctance to confirm death sentences underscores the need for deeper reforms in criminal justice and sentencing practices.

GURU RAVIDAS

TOPIC: (GS1) HISTORY: INDIAN EXPRESS

Why in News?

The Prime Minister inaugurated Adampur Airport in Punjab and renamed it in honour of Guru Ravidas on his birth anniversary.

Early Life and Background

- Born in a family traditionally associated with leather work.

- Birthplace is now revered as Shri Guru Ravidass Janam Asthan.

- Associated with the Bhakti teacher Ramananda and lived around the time of Kabir.

- Also known by names such as Raidas and Rohidas in different regions.

- His birth anniversary is celebrated as Ravidas Jayanti.

Literary Contributions

- Composed devotional poetry in local dialects, making spirituality accessible to common people.

- 41 hymns attributed to him are included in the Guru Granth Sahib.

- His verses also appear in the Panch Vani tradition of the Dadu Panth.

- His poetry combines devotion (bhakti) with social reform messages.

Philosophy and Teachings

- Rejected caste discrimination and promoted human equality.

- Emphasised nirguna bhakti — worship of a formless, attribute-less divine.

- Advocated inner purity, humility and moral conduct over rituals.

- Vision of an ideal society called “Beghumpura” — a land without sorrow, inequality or fear.

- Symbol of resistance against untouchability and social injustice.

- Influenced spiritual figures like Mirabai, who is believed to have regarded him as her guru.

Ravidassia Religion

- His teachings form the base of the Ravidassia religion.

- Followers revere the Amrit Bani Guru Ravidass as their sacred text.

- The community emphasises equality, devotion and ethical living.

Significance in Indian Society

- Key figure of the Bhakti Movement that democratized religion.

- Strengthened the idea of social justice and dignity for marginalized groups.

- His teachings remain relevant for constitutional values of equality and fraternity.