A COURT RULING WITH NO ROOM FOR GENDER JUSTICE

TOPIC: (GS1) SOCIAL ISSUES: THE HINDU

The Supreme Court, in the Shivangi Bansal vs Sahib Bansal case (July 2024), upheld directions of the Allahabad High Court that prevent arrest or coercive action for two months in domestic cruelty cases under Section 498-A IPC (now Section 85 of Bharatiya Nyaya Sanhita).

Background on Section 498-A

- Introduced in IPC in 1983 to address cruelty against married women by husbands or their relatives.

- Covers dowry-related harassment, mental and physical abuse, and acts that push women towards suicide.

- Punishment: Imprisonment up to 3 years + fine.

- Enacted in response to increasing dowry deaths and domestic cruelty, with intent to harmonise with other laws like the Dowry Prohibition Act, 1961.

Supreme Court’s Endorsement of ‘Cooling-off’ Period

- Allahabad High Court ordered a two-month halt on arrests/coercive steps after a complaint.

- Directed formation of district Family Welfare Committees to assess complaints during this period.

- Supreme Court upheld these directions without detailed socio-political examination.

- Impact:

- Police cannot make immediate arrests, even in serious cruelty cases.

- Puts complainants’ safety at risk.

- May discourage women from lodging complaints.

Concerns Raised

- Criminal cases involving violence are different from family disputes like custody/divorce, where mediation works better.

- Delayed action legitimises police inaction and weakens deterrence against domestic violence.

- Reduces victims’ access to timely protection under law.

Debate on ‘Misuse’ of Law

- Courts have earlier expressed concerns on misuse (e.g., Preeti Gupta, Sushil Kumar Sharma, Arnesh Kumar cases).

- NCRB 2022 conviction rate ~18% — higher than many other crimes.

- Low conviction often due to:

- Poor investigation.

- Social/familial pressure on women to withdraw cases.

- Difficulty in proving offences in private/domestic spaces.

Ground Reality

- NCRB 2022: 1.34 lakh cases registered under Section 498-A.

- NFHS-5: Significant underreporting of violence against women in many States.

- Rising case numbers linked to increased awareness, not necessarily misuse.

- False cases possible in any law — but validity of complaint must be tested through investigation, not blanket suspension.

Key Concern

- Selective suspension of criminal provisions undermines uniformity in law.

- Contradicts the Court’s earlier stance that “misuse is no ground to strike down a law.”

Conclusion:

The ruling may unintentionally weaken legal safeguards for victims of domestic violence and make it harder for them to seek timely justice. Balancing concerns of misuse with the need for protection remains a critical challenge.

SEAFOOD EXPORT ISSUE

TOPIC: (GS3) ECONOMY: THE HINDU

At the Seafood Exporters Meet in New Delhi, the Union Government urged exporters to diversify beyond the U.S. market. Stakeholders sought government help to address tariff and non-tariff barriers affecting seafood exports.

Background

- The U.S. is India’s largest seafood export market, but exporters face tariff hurdles and certification requirements.

- In 2023–24, U.S. imports of Indian seafood were worth $2.54 billion, forming 34.53% of India’s seafood export value.

- China, Japan, and Vietnam follow as major destinations.

Government’s Response

- Union Minister Rajiv Ranjan Singh’s Statement: Ministry will help exporters explore alternative markets like EU, Japan, South Korea, U.K., Russia, Australia, West Asia, and Southeast Asia.

- Emphasis on resilience and market diversification to reduce dependence on the U.S. Encouraged exporters to add value through processing and innovation.

Challenges Highlighted by Exporters

- Tariff Barriers

- Non-Tariff Barriers

- Infrastructure Gaps:

- Inadequate cold chain facilities.

- Limited processing units for niche products like rainbow trout.

Tariff Barriers

- These are taxes or duties that a country charges on imported goods.

- Purpose: To make foreign goods costlier so that local products become more competitive.

- Example: If the U.S. charges 10% import duty on Indian shrimp, the price of Indian shrimp in the U.S. market will go up.

Non-Tariff Barriers (NTBs)

- These are rules, standards, or procedures that make it harder to sell foreign goods, without directly charging a tax.

- Can include strict quality checks, lengthy approvals, certifications, or quotas.

- Example: A country demanding special farm certification for fish farms before allowing imports.

Tariff = direct tax on imports;

Non-tariff = rules & restrictions that indirectly limit imports.

Significance

- Diversification will safeguard export revenues from policy shifts or trade restrictions in a single market.

- Addressing infrastructure and certification gaps can enhance India’s competitiveness in global seafood trade.

- Aligns with broader trade strategy of expanding into multiple high-value markets.

SEAFOOD EXPORTS AND FISHERIES PRODUCTION

Rising Export Value

- India achieved an all-time high in seafood exports during FY 2023–24, with export volume reaching 17.82 lakh tonnes valued at approximately ₹60,524 crore (about USD 7.4 billion).

Global Export Ranking

- As of 2024–25, India stands as the fourth-largest exporter of marine products globally, supplying to 130 countries, up from 105 countries in 2014–15

Rapid Export Growth in FY 2024–25

- Export volume surged to 16.85 lakh metric tonnes, marking over 60% increase compared to previous years; export value rose to about USD 7.2 billion

Production Growth Over Two Decades

- Total fish production jumped from 95.79 lakh tonnes (2013–14) to 184.02 lakh tonnes (2023–24)—an increase of nearly 88 lakh tonnes in 10 years

Aquaculture Dominates Output

- Aquaculture and inland fisheries now account for around 75% of India’s total fish production, with marine fisheries contributing the balance

GDP & Economic Contribution

- Fisheries and aquaculture contribute about 1.1% of India’s GDP and around 6–7% of agricultural GDP, with Gross Value Added (GVA) at nearly ₹2 trillion in 2023

INCOME TAX BILL, 2025

TOPIC: (GS3) ECONOMY: THE HINDU

The Lok Sabha has passed the revised Income Tax (No. 2) Bill, 2025, replacing the 1961 Act. The Bill reduces length and complexity but grants broader powers to tax officials, including access to personal digital data during searches.

Key Features of the New Bill

- Length Reduction: Word count cut from ~5.12 lakh to ~2.59 lakh words.

- Structural Changes:

- Chapters reduced from 47 to 23.

- Sections reduced from 819 to 536.

- Improved Clarity:

- Tables increased from 18 to 57.

- Formulae increased from 6 to 46.

- Simplification Aim: Easier interpretation for taxpayers and authorities.

Expanded Powers During Search Operations

- Any person with electronic records must assist tax officials by providing access, including passwords.

- If access codes are not provided, officials can override security to enter computer systems.

- Aim: To access potentially incriminating evidence such as emails, WhatsApp chats, and other digital documents.

Support and Concerns

- Select Committee’s View: Justified powers due to frequent non-cooperation in sharing passwords; electronic records are often key evidence.

- Dissenting Opinions:

- Amar Singh (Congress): Claimed provisions allow excessive intrusion into personal data.

- N.K. Premachandran (RSP): Warned of potential misuse and infringement on the constitutional Right to Privacy as upheld in the Puttaswamy judgment. Suggested retaining 1961 Act’s original safeguards.

Significance and Implications

- For Administration: Could strengthen investigative capacity of tax authorities.

- For Citizens: Raises privacy concerns over access to personal emails, chats, and social media accounts.

- For Policy Debate: Highlights tension between tax enforcement and fundamental rights.

- Next Steps: Implementation and potential judicial review may determine the scope of these powers.

changes needed in the Income Tax Bill:

- Simplify tax structure: Reduce complexity in slabs, exemptions, and compliance rules to make it easier for taxpayers and reduce disputes.

- Promote equity : Ensure fair taxation by widening the tax base, curbing loopholes, and introducing measures to tax high-income earners effectively.

- Encourage investment & growth: Offer stable and predictable tax policies with incentives for innovation, startups, and green projects.

Conclusion:

The new Income Tax Bill aims to simplify the law and strengthen tax enforcement but raises serious privacy concerns. Its future impact will depend on safeguards in implementation and possible judicial scrutiny.

CENTRE REJECTS PAKISTAN’S NUCLEAR THREATS OVER INDUS PROJECTS

TOPIC: (GS2) INTERNATIONAL RELATIONS: THE HINDU

The Ministry of External Affairs (MEA) firmly dismissed Pakistan Army Chief Asim Munir’s remarks threatening nuclear retaliation against India’s dam projects on the Indus River. India stated that its projects comply with the Indus Waters Treaty and termed the threats as “irresponsible.”

Background

- The Indus Waters Treaty (IWT) was signed in 1960 between India and Pakistan, with the World Bank as a mediator.

- It allocates control of the three eastern rivers (Ravi, Beas, Sutlej) to India and the three western rivers (Indus, Jhelum, Chenab) to Pakistan, while allowing limited use of western rivers by India for non-consumptive purposes like hydroelectricity.

- Disputes over interpretation have often led to political and diplomatic tensions.

Pakistan’s Claim

- Alleged that India’s dam and hydroelectric projects on the Indus and its tributaries breach the treaty’s provisions.

- Warned of using “all means necessary,” including the nuclear option, if India continues with the projects.

India’s Response

- Categorically rejected the nuclear threats, calling them provocative and unacceptable.

- Reaffirmed that all projects are designed within the treaty’s technical limits.

- Stated that water-related disputes should be addressed through established mechanisms under the IWT.

Strategic Concerns

- Mistrust in South Asia – Reflects deep-rooted political hostility between India and Pakistan.

- Nuclear Risk – Raises concerns over escalation from a water-sharing dispute to a security crisis.

- Hydro-politics – Highlights how water management can be weaponized in geopolitical conflicts.

Way Forward

- Diplomatic Dialogue – Use bilateral and commission-level talks to resolve technical differences.

- Transparency Measures – Share project designs and data to build trust.

- Regional Hydro-diplomacy – Strengthen cooperative water management to prevent politicization.

Conclusion:

The episode underlines the need for responsible rhetoric, adherence to treaty frameworks, and proactive diplomacy to prevent water disputes from escalating into larger security threats in South Asia.

FROM BENEFICIARIES TO PARTNERS: STRENGTHENING CITIZEN ROLE IN HEALTH GOVERNANCE

TOPIC: (GS2) INDIAN POLITY: THE HINDU

At the 76th World Health Assembly (WHA), global discussions emphasized the need to transform citizens from passive recipients of healthcare into active partners in shaping health policy, delivery, and accountability mechanisms.

Importance of Citizen Participation in Health

- Encourages community-driven decisions that reflect local needs.

- Enhances transparency and accountability in healthcare services.

- Helps bridge the trust gap between government institutions and the public.

- Promotes equitable resource allocation for marginalized populations.

Challenges in Current Health Governance

- Top-down policy approach with limited community consultation.

- Weak institutional mechanisms for citizen feedback and oversight.

- Lack of awareness and capacity among citizens to engage in policy discussions.

- Fragmented representation of civil society in decision-making bodies.

Global and Indian Context

- Global: Countries like Brazil and Thailand have institutionalized citizen councils for health decision-making.

- India: Initiatives like Rogi Kalyan Samitis and Village Health Sanitation and Nutrition Committees exist but face gaps in implementation and participation.

Way Forward

- Institutionalize formal platforms for public health dialogue.

- Strengthen community-based monitoring and grievance redress systems.

- Enhance public health literacy to empower informed participation.

- Integrate civil society and community leaders into policy-making forums.

Conclusion

Transforming citizens from mere beneficiaries to active partners in health governance will foster trust, improve accountability, and make health systems more responsive to real community needs.

U.S. SLAPS TARIFFS ON INDIA OVER RUSSIA TRADE

TOPIC: (GS2) INTERNATIONAL RELATIONS: INDIAN EXPRESS

U.S. President Donald Trump has announced a 25% tariff on Indian goods, citing India’s oil and defence imports from Russia as a major reason. India has defended its trade with Russia, pointing to similar or higher imports by the EU and continued U.S. purchases from Moscow.

Background

- After Russia’s invasion of Ukraine (Feb 2022), Western nations, led by the U.S., imposed sanctions and a price cap on Russian oil.

- India increased imports of discounted Russian crude to ensure energy security, a move the MEA says was encouraged by the U.S. to maintain global market stability.

- India’s defence ties with Russia date back decades but have seen diversification in recent years.

India’s Oil Imports from Russia

- Rise in Share: From 13.1% in 2022 to over 35% in 2023–24 (Chart 1).

- Imports from Iraq and Saudi Arabia declined during this period.

- The EU’s total fossil fuel imports from Russia (€212 billion since 2022) are higher than India’s (€130 billion).

- Some EU states, like the Netherlands, import refined petroleum from India, which often comes from Russian crude.

U.S. and EU’s Continued Trade with Russia

- Despite sanctions, the EU remains a major importer of Russian fossil fuels, critical minerals, and industrial goods.

- The U.S. reduced overall imports from Russia by 55%, but still bought over $800 million worth of fertilizers in 2025 (till February).

- India accuses both the U.S. and EU of “double standards” for criticising others while maintaining their own trade links.

India’s Defence Imports from Russia

- Over 50% of India’s arms imports since 2022 came from Russia (Chart 3).

- However, long-term trend shows declining dependence, with increased purchases from France, U.K., and the U.S.

- Defence ties with Russia remain due to existing platforms, spare parts needs, and strategic considerations.

Criticism and Counterpoints

- Trump linked India’s Russia trade to lack of concern over the Ukraine conflict.

- India points to the U.S.’s role as Israel’s main arms supplier (over 80% since 1949; 100% since 2022 — Chart 4), despite allegations of genocide in Gaza and attacks on neighbouring countries.

- Argument: Criticism is selective — ignores indirect trade and geopolitical realities.

Key Takeaways

- India’s Russia imports are significant but not unique; EU and China are larger energy importers.

- U.S. and EU maintain selective trade with Russia despite sanctions.

- Defence imports from Russia are declining, but legacy systems keep ties strong.

- The issue reflects geopolitical double standards and competing strategic interests.

Conclusion:

The U.S. tariffs highlight how geopolitical rivalries are spilling into trade policy.

India’s pushback signals its intent to defend strategic autonomy while exposing Western double standards.

GOOGLE ANTITRUST CASE

TOPIC: (GS2) INDIAN POLITY: THE HINDU

The Supreme Court has accepted appeals by Google’s parent Alphabet, the Competition Commission of India (CCI), and the Alliance Digital India Foundation (ADIF) over alleged abuse of dominance in the Android ecosystem. The case will be heard in November 2025, with implications for digital market regulation in India.

Background

- CCI’s probe (2020) began after complaints from app developers about restrictive Android practices.

- In 2022, CCI found Google guilty of anti-competitive conduct, imposing a ₹936.44 crore fine and behavioural restrictions.

Key Findings of CCI

- Mandatory Google Play Billing System (GPBS): Developers forced to use Google’s in-app payment system with 15–30% commission.

- Self-preference: Google exempted YouTube from GPBS charges.

- Bundling of Apps: Play Store access tied to pre-installing Google apps like Search, Chrome, and YouTube.

- Market Harm: Reduced competition and innovation, disadvantaging rival app providers.

Google’s Defence

- Android is open-source; OEMs can skip Google apps if they forgo Play Store access.

- Pre-installation ensures convenience and security.

- GPBS maintains transaction safety and ecosystem funding.

- Commission rates are industry standard.

NCLAT Ruling (March 2025)

- Abuse Confirmed: Upheld findings on mandatory billing and bundling.

- Penalty Reduced: From ₹936.44 crore to ₹216.69 crore as original fine was disproportionate.

- Remedies Modified: Retained key directives like billing data transparency and ban on self-use of such data.

Impact on India

- For Consumers: More payment choices, potential lower app prices, and better data privacy.

- For Startups: Increased bargaining power and freedom to integrate alternate payment systems.

- For Digital Economy: Sets a precedent for regulating global tech giants, shaping fair competition in India’s digital markets.

Road Ahead

- November 2025 hearings will clarify “abuse of dominance” for digital platforms under Indian competition law.

- With Android powering 95% of Indian smartphones, the verdict will influence app access, payments, and user experience nationwide.

NCLAT (NATIONAL COMPANY LAW APPELLATE TRIBUNAL)

- Purpose – NCLAT hears appeals against orders of the National Company Law Tribunal (NCLT), Insolvency and Bankruptcy Board of India (IBBI), Competition Commission of India (CCI), and related authorities.

- Establishment – It was set up under Section 410 of the Companies Act, 2013 and started functioning from June 2016.

- Key Features –

- Headed by a Chairperson (usually a retired Supreme Court or High Court judge).

- Has both judicial and technical members for specialized handling of corporate, insolvency, and competition law matters.

- Its decisions can be appealed to the Supreme Court of India.

Conclusion

The case will define how India balances innovation with market fairness in the digital era.

Its outcome could reshape the Android ecosystem and global tech regulation norms.

SYLHETI LANGUAGE

TOPIC: (GS2) INTERNATIONAL RELATIONS: THE HINDU

Recently, a public remark comparing Sylheti to Bangladeshi dialects triggered debates over its separate identity and historical roots in India.

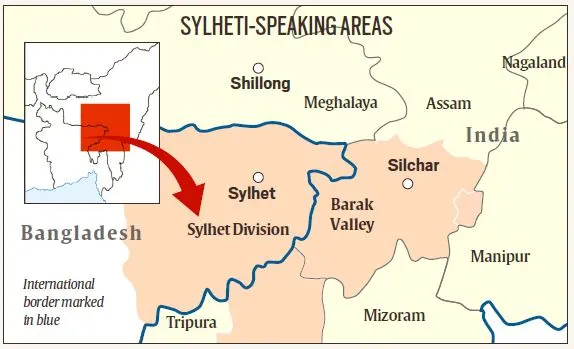

- Sylheti is spoken mainly in South Assam’s Barak Valley and in the Sylhet Division of present-day Bangladesh.

- It is also used in parts of Meghalaya and Tripura.

- Although related to Bengali, Sylheti has its own pronunciation style, vocabulary, and grammar patterns.

Linguistic Status

- Debated Identity: Some view Sylheti as a dialect of Bengali due to mutual understanding between speakers of both. Others, including linguists and native speakers, classify it as a separate language.

- Unique Features: Distinct phonetic sounds not present in standard Bengali. Certain words and sentence structures are exclusive to Sylheti.

Sociolinguistic Context

- Diglossia:

- In regions where Sylheti is spoken, two languages are used side by side:

- Formal: Standard Bengali for education, administration, and literature.

- Informal: Sylheti for daily conversations.

- This dual use impacts language preservation and intergenerational learning.

Significance

- Acts as a marker of cultural identity for communities in Assam’s Barak Valley and neighbouring areas.

- Part of India’s linguistic diversity, highlighting the need for recognition and preservation efforts.

Conclusion

Sylheti is more than just a variant of Bengali — it carries a distinct cultural and linguistic heritage. Recognising its uniqueness can help safeguard the identity of its speakers and enrich India’s multilingual fabric.