ETHANOL BLENDING IN PETROL

TOPIC: (GS3) ECONOMY: THE HINDU

The Government of India has advanced its target of achieving 20% ethanol blending (E20) in petrol by 2025. Recently, E20-compatible vehicles were launched (April 2025), sparking debates on its impact on mileage, maintenance costs, and older vehicles.

Ethanol:

- Ethanol (ethyl alcohol) is a biofuel made from biomass (plant waste).

- Acts as an oxygenate when blended with petrol, allowing cleaner and more efficient combustion.

- Sources in India:

- Sugarcane-based products: C-heavy molasses, B-heavy molasses, sugarcane juice, sugar/syrup.

- Damaged food grains: broken rice, maize.

- Advanced sources: cellulosic & lignocellulosic biomass (non-edible plant matter).

HOW ETHANOL IS PRODUCED

Raw Material Collection

- Ethanol is mainly made from sugarcane, corn, wheat, rice, or other biomass.

- Sometimes, molasses (a by-product of sugar industry) is also used.

Preparation of Raw Material

- Grains are ground into powder/flour.

- Sugarcane juice or molasses is diluted with water.

Conversion to Sugars

- Starches in grains are broken down into simple sugars using enzymes.

- This process makes the material ready for fermentation.

Fermentation

- Sugary solution is mixed with yeast.

- Yeast converts sugars into ethanol + carbon dioxide (CO₂).

Distillation

- The mixture is heated to separate ethanol from water and other impurities.

- Ethanol has a lower boiling point, so it is collected as vapor and cooled back to liquid.

Dehydration (Optional)

- For fuel-grade ethanol, water is further removed to get nearly 100% pure ethanol.

Final Use

- The ethanol can be blended with petrol (like E20, E100) or used in medicines, sanitizers, and industry.

Scientific Aspects

- Calorific Value: Ethanol has lower energy per litre than petrol → possible drop in mileage. Govt. claims losses are marginal and depend on driving habits & maintenance.

- Octane Number: Ethanol has a higher octane rating, reducing engine knocking and improving combustion. But lower energy density means less energy extracted per litre of blended fuel.

- Hygroscopic Nature: Ethanol absorbs water → risk of corrosion in fuel tanks, pipes, injectors. More impact on older vehicles with rubber parts and carburetor systems.

Global Comparison – Brazil’s Example

- Brazil started blending in 1975 (Proálcool programme), gradually moving to E27 petrol.

- Focused on research, subsidies, flex-fuel vehicles, and decades-long transition.

- India’s faster shift (E10 → E20 in just a few years) has created adaptation challenges.

Challenges in India

- Older vehicles (pre-BS VI) lack electronic control units → difficult to adapt to E20.

- Fuel system components prone to corrosion and clogging.

- Need for engine recalibration (spark timing, air-fuel ratio) in some vehicles.

- Higher initial service and replacement costs.

Way Forward

- Gradual transition with flex-fuel vehicles.

- Incentives for second-generation ethanol (non-food biomass).

- Awareness for vehicle-owners on servicing and part replacements.

- Balance between energy security, import reduction, and consumer concerns.

Conclusion

India’s ethanol blending programme promises cleaner energy, reduced oil imports, and support to farmers. However, unlike Brazil’s phased approach, India’s rapid rollout raises concerns about vehicle compatibility, corrosion, and costs. A paced, technology-driven transition with consumer safeguards will be key to long-term success.

NOMINATIONS TO UNION TERRITORY ASSEMBLIES

TOPIC: (GS2) INDIAN POLITY: THE HINDU

The Union Home Ministry informed the J&K and Ladakh High Court that the Lieutenant Governor (LG) of J&K can nominate five members to the J&K Assembly without the aid and advice of the Council of Ministers. This raises key questions about democratic accountability and the role of the LG in Union Territories with legislatures.

Constitutional Provisions on Nominated Members

- Parliament: 12 members are nominated to the Rajya Sabha by the President (on advice of Union Council of Ministers).

- State Assemblies: Earlier, Governors could nominate one Anglo-Indian member (discontinued in 2020).

- Legislative Councils: In six States, about one-sixth members are nominated by Governors (on advice of State Council of Ministers).

Union Territories with Assemblies

- Delhi (1991 Act): 70 elected members; no nominated MLAs.

- Puducherry (1963 Act): 30 elected MLAs + up to 3 nominated by Union Government.

- Jammu & Kashmir (2019 Reorganisation Act, amended 2023): 90 elected members.

- LG can nominate up to five members:

- Two women

- Two Kashmiri migrants

- One displaced person from Pakistan-occupied Kashmir.

- LG can nominate up to five members:

Judicial Standpoints

Puducherry Case (K. Lakshminarayanan vs Union of India, 2018)

- Madras HC: Upheld Union Government’s right to nominate members without consulting UT Ministers, but suggested clearer procedure.

- SC (on appeal): Set aside these recommendations.

Delhi Case (Govt. of NCT vs Union of India, 2023)

- SC introduced the “Triple Chain of Accountability”:

- Civil servants → accountable to Ministers.

- Ministers → accountable to Legislature.

- Legislature → accountable to People.

- Held that LG must act on advice of Council of Ministers in all matters except those beyond Assembly’s legislative powers.

- This reasoning may also apply to nominations in UT Assemblies.

- SC introduced the “Triple Chain of Accountability”:

Concerns with Nominated MLAs

- In smaller assemblies (Puducherry, J&K), nominated members can alter majority equations, potentially destabilising elected governments.

- Risk of political misuse if nominations bypass elected Council of Ministers.

- Goes against democratic principles of accountability to the people.

Way Forward

- While UTs do not have the full powers of States, their elected governments must remain accountable to the people.

- In J&K, which earlier had special statehood, democratic safeguards are even more important.

- Best approach: LG should make nominations on the advice of the elected Council of Ministers, to protect democratic values and prevent misuse.

DIFFERENCE BETWEEN STATES AND UNION TERRITORIES (UTS) IN INDIA

Formation & Authority

- States: Created on the basis of language, culture, or administrative convenience. They have their own government.

- UTs: Created mainly for administrative reasons, smaller size, or strategic importance.

Governance

- States: Have their own elected Legislature, Chief Minister, and Council of Ministers.

- UTs: Directly governed by the President of India through an Administrator/Lieutenant Governor (except Delhi, Puducherry, and J&K which have legislatures).

Powers

- States: Have powers under the State List of the Constitution and can make their own laws.

- UTs: Limited powers; most laws are made by Parliament (except in UTs with legislatures).

Representation

- States: Have representation in both Lok Sabha and Rajya Sabha.

- UTs: Have representation in Lok Sabha, but only Delhi, Puducherry, and J&K have seats in Rajya Sabha.

Simple way to remember:

- States = Full governments with more autonomy.

- UTs = Smaller regions, mostly controlled by the Centre.

Conclusion

The issue of nominated MLAs in UT Assemblies highlights the tension between Centre’s control and local democratic accountability. In J&K, where restoration of statehood has been promised, following the principle of ministerial advice in nominations would strengthen democracy and uphold the will of the people.

TRUE EMPOWERMENT OF WOMEN

TOPIC: (GS2) SOCIAL JUSTICE: THE HINDU

The recent case involving former MP Prajwal Revanna highlighted how a domestic worker, despite lacking wealth or connections, stood firm against powerful intimidation. The episode raises critical questions about what real women empowerment means in India beyond symbolic praise.

Background

- India often celebrates women CEOs, politicians, and entrepreneurs as symbols of empowerment.

- However, women without privilege, fighting legal battles against abuse or harassment, rarely receive the same recognition or sustained support.

- Such women strengthen justice for all, yet after legal victories, they often face stigma, job loss, and financial hardship.

Gaps in the Current Empowerment Model

- Surface-level recognition: Media and state praise survivors temporarily, but support fades once trials end.

- Economic hardship: Survivors struggle with debts from prolonged legal battles.

- Social stigma: Many face discrimination in their communities or workplaces.

- Lack of structural support: No dedicated schemes to ensure survivors can rebuild their lives.

Key Measures Needed

- Financial Security: Create state-funded survivor compensation schemes, similar to aid for victims of terrorism or accidents. Compensation should cover legal costs and ensure a stable recovery period.

- Legal Assistance: Set up dedicated survivor legal aid cells with trained advocates, forensic experts, and victim support staff. Ensure funding at par with public prosecutors in high-profile cases.

- Employment Pathways: Governments, PSUs, and corporates should provide job quotas for women who fought abuse cases. Such support gives survivors dignity and independence.

- Psychological Support: Provide long-term counselling, peer networks, and therapy, funded by state and supplemented by CSR initiatives. Treat trauma care as a right, not a privilege.

Institutionalising Survivor Experience

- Train survivors as counsellors in police stations, mentors in legal literacy programs, and members of Internal Complaints Committees under POSH.

- This ensures their lived experience benefits other women and provides sustainable employment.

Why It Matters

- These women fight against entrenched power, often at personal risk, making them symbols of resilience.

- Supporting them sends a clear message: the state stands by survivors, not abusers.

- Real empowerment means securing their future with economic, legal, and emotional support, not just celebrating symbolic victories.

Conclusion

Applause is temporary, but empowerment must be lasting. True women empowerment is achieved only when survivors of injustice are provided financial stability, professional integration, and a respected role in shaping institutions.

GLOBAL PLASTIC TREATY NEGOTIATIONS

TOPIC: (GS2) INTERNATIONAL RELATIONS: THE HINDU

The sixth round of UNEP-led negotiations (since 2022) on a global treaty to tackle plastic pollution failed to reach consensus. Deep divisions remain among countries on whether addressing plastic pollution requires cutting production itself.

Global scenario:

- The world produces 430 million tonnes (MT) of plastic annually, two-thirds of which are short-lived products.

- 46% ends up in landfills, and 22% is mismanaged and turns into litter.

- In 2019, plastics contributed 1.8 billion MT of greenhouse gas emissions (3.4% of global total).

India’s case:

- Generates 3.4 MT of plastic waste annually, but recycles only 30%.

- Consumption increased from 14 MT (2016-17) to over 20 MT (2019-20).

- Ban exists on 20 single-use plastic items (cups, straws, spoons), but impact on waste management remains limited.

Key Issues in Negotiations

- Waste Management vs. Production Cuts: Some countries argue that better recycling and market incentives can manage the plastic waste problem. Others insist that reducing production at the source is the only sustainable solution.

- Microplastics & Food Systems: Growing evidence shows plastic entering human, animal, and marine food chains. Island nations are overwhelmed by plastic debris washing up on their shores.

- Trade Concerns: Many countries fear that calls to reduce plastic production could be disguised trade barriers. Rising tariff uncertainties make negotiations more difficult.

India’s Position & Challenges

- Ban on some single-use plastics has nudged consumers toward paper and cloth alternatives.

- However, lack of strong recycling infrastructure limits the effectiveness of such bans.

- Need for better collection, segregation, and circular economy models.

Way Forward

- Build mutual trust among nations to avoid deadlock in treaty talks.

- Recognise plastic as both an environmental and health hazard, not just a convenience product.

- Invest in technologies for recycling, biodegradable substitutes, and global cooperation.

- Balance between economic interests and the urgency of environmental protection.

Conclusion

Without trust and willingness to compromise, future treaty meetings will face the same deadlock. Plastic pollution is no longer just a waste issue but a global climate, health, and trade challenge. Real progress requires collective commitment to both manage waste better and curb unnecessary production.

THE PATH TO ENDING GLOBAL HUNGER AND INDIA’S ROLE

TOPIC: (GS2) INTERNATIONAL RELATIONS: THE HINDU

The UN’s State of Food Security and Nutrition in the World 2025 report shows a decline in global undernourishment. India’s progress in reducing hunger has been highlighted as a key driver of this positive global trend.

Background

- In 2024, 673 million people (8.2% of the world population) were undernourished, a fall from 688 million in 2023.

- India’s undernourishment rate declined from 14.3% (2020–22) to 12% (2022–24), meaning 30 million fewer people living with hunger.

- This improvement is remarkable considering the pandemic’s disruptions.

Transformation of Public Distribution System (PDS)

- PDS reforms have been central to India’s hunger reduction.

- Key features:

- Digitalisation with Aadhaar-enabled verification.

- Real-time inventory tracking and biometric authentication.

- One Nation, One Ration Card making entitlements portable for migrant workers.

- During COVID-19, these measures allowed over 800 million people to access subsidised food.

From Calories to Nutrition

- While calorie availability has improved, nutritional challenges remain:

- 60% of Indians cannot afford a healthy diet due to high prices of protein-rich and nutrient-dense foods.

- Weak supply chains and lack of cold storage worsen the problem.

Government initiatives:

- PM POSHAN (2021) – school meals focusing on dietary diversity.

- Integrated Child Development Services (ICDS) – nutrition-sensitive approach for children and mothers.

- New UN data shows some progress in making healthy diets more affordable, despite food inflation.

Structural Challenges in Nutrition

- Even as hunger declines, malnutrition, obesity, and micronutrient deficiencies are rising, especially in poor rural and urban areas.

- This indicates a need for agrifood system transformation beyond basic food distribution.

Transforming India’s Agrifood System

- Priorities for the future:

- Increase production and affordability of pulses, fruits, vegetables, and animal-based foods.

- Build cold storage and logistics systems to reduce the 13% food lost post-harvest.

- Strengthen Farmer Producer Organizations (FPOs) and women-led food enterprises, particularly in climate-resilient crops.

- Use digital tools — AgriStack, e-NAM, geospatial platforms — for better planning and nutrition delivery.

Global Significance of India’s Role

- India’s progress is a model for the Global South, showcasing how digital governance and strong safety nets can reduce hunger.

- With just five years to achieve SDG-2 (Zero Hunger), India’s continued leadership is vital.

- Shift needed: from ensuring food security to ensuring nutrition, resilience, and opportunity.

Conclusion

India has shown that hunger reduction at scale is possible with political will, smart investments, and inclusive governance. The fight against global hunger will depend heavily on India’s ability to move from feeding its people to nourishing them.

GST REFORMS AND REVENUE CONCERNS

TOPIC: (GS2) INDIAN POLITY: THE HINDU

The Union Government has proposed major reforms in GST rates and procedures in 2025. These changes aim to reduce tax burden, simplify compliance, and boost domestic consumption, though they may lower short-term revenues.

Background

- GST was introduced in 2017 to create a single indirect tax system across India.

- However, multiple tax slabs, complex procedures, and frequent disputes created challenges for businesses and taxpayers.

- The latest reforms attempt to address these issues and make the system more growth-friendly.

Proposed GST Rate Reforms

- Rationalisation of slabs: 99% of items from the 12% slab shifted to 5%. 90% of items from the 28% slab moved to 18%.

- Objective: Reduce consumer burden and bring similar products under the same tax rate.

- Expected impact: Fewer disputes, less confusion, and improved ease of doing business.

Procedural Reforms

- Simplified registration process for businesses.

- Easier return filing to reduce time and compliance costs.

- Faster refunds to ease liquidity pressures, especially for MSMEs.

- Emphasis on making GST not only rate-friendly but also administratively simple.

Revenue Impact

- RBI had earlier estimated the average GST rate at 11.6%; this will now fall significantly.

- Government anticipates a revenue shortfall initially but expects:

- Higher domestic consumption.

- Wider tax base.

- Lower tax evasion and reduced input tax credit frauds.

- Thus, long-term revenue may stabilize despite the initial dip.

State Governments’ Concerns

- States are worried about loss of revenue due to lower GST rates.

- Already pressing the 16th Finance Commission for a larger share in central taxes.

- Petroleum products (a key revenue source) unlikely to be brought under GST soon.

- States may not openly oppose reforms but could demand compensation from the Centre.

Significance

- These reforms, combined with changes in income tax slabs and the new Direct Tax Code, make 2025 a landmark year for India’s tax system.

- By prioritising consumption-driven growth over revenue concerns, the government signals a pro-growth, reform-oriented approach.

Conclusion

GST reforms underline the Centre’s willingness to trade short-term revenue for long-term growth. Balancing consumer relief, business ease, and state concerns will determine the success of this bold tax reform agenda.

ALASKAN WINDS, INDIA AND THE TRUMP-PUTIN SUMMIT

TOPIC: (GS2) INTERNATIONAL RELATIONS: THE HINDU

The Trump-Putin “Alaska Summit” (August 15, 2025) was seen as a possible turning point in the Russia-Ukraine conflict. For India, however, the summit did not bring relief on sanctions, tariffs, or trade disputes with the U.S., raising questions over its diplomatic space and strategy.

Background

- India has been balancing its ties with both the U.S. and Russia.

- New Delhi expected that U.S.-Russia rapprochement would ease pressure on India over its Russian oil imports and trade issues.

- Instead, U.S. policies towards India remained tough, with no rollback of sanctions or tariffs.

Key Takeaways for India

No Policy Shift towards India

- Despite the friendly Trump-Putin meeting, no softening of U.S. stance on India was visible.

- U.S. secondary sanctions on Indian oil imports from Russia remain in place.

- U.S. trade talks with India continue to be stalled; reciprocal tariffs are still effective.

Operation Sindoor Dispute

- The U.S. version of Operation Sindoor (May 2025) differs from India’s account.

- Mr. Trump claimed credit for mediating the India-Pakistan ceasefire, contradicting India’s narrative.

- This has created tension as the Modi government is reluctant to accept U.S. claims.

Summitry vs. Substance

- India’s foreign policy in recent years has relied heavily on leader-to-leader chemistry.

- But outcomes of personal diplomacy have been limited — e.g., Modi-Xi meetings did not prevent the 2020 border clashes.

- With the U.S., high-profile rallies (Howdy Modi, Namaste Trump) also failed to ensure sustained understanding.

- Lesson: Focus must shift from optics to concrete agreements.

Need for Political Balance

- India’s close association with particular leaders (e.g., Trump in 2020, Biden later) has created friction.

- Maintaining bipartisan ties in the U.S. is crucial to avoid instability whenever power shifts.

- Similar lessons apply in South Asia (Bangladesh, Sri Lanka, Maldives).

Strategic Autonomy in Energy

- U.S. penalties on Indian oil imports highlight the risks of bowing to unilateral sanctions.

- India had earlier cut Iranian and Venezuelan oil imports under U.S. pressure, hurting its own interests.

- Upholding the principle of only following UN-approved sanctions strengthens India’s credibility, especially in the Global South.

India’s Way Forward

- New Delhi should:

- Diversify trade partners (Japan, China, SCO, G-20 platforms).

- Take a firmer stance against unfair U.S. tariffs and restrictions.

- Rebuild India’s agency in foreign policy by prioritizing national interest over external pressure.

HISTORY OF ALASKA’S SUCCESSION BETWEEN RUSSIA AND USA

- Russian Rule (1740s–1867): Russia controlled Alaska after explorers and fur traders settled there in the 18th century, using it mainly for fur trade.

- Sale to the USA (1867): Russia sold Alaska to the United States for $7.2 million, as it was difficult for Russia to defend and manage the distant territory.

- US Territory to Statehood (1867–1959): Alaska was governed as a U.S. territory and later became the 49th state of the USA in 1959.

Conclusion

The Alaska Summit showed that U.S.-Russia warmth does not guarantee relief for India. New Delhi must reduce reliance on personal diplomacy, safeguard strategic autonomy, and build balanced, issue-based relations to secure its long-term interests.

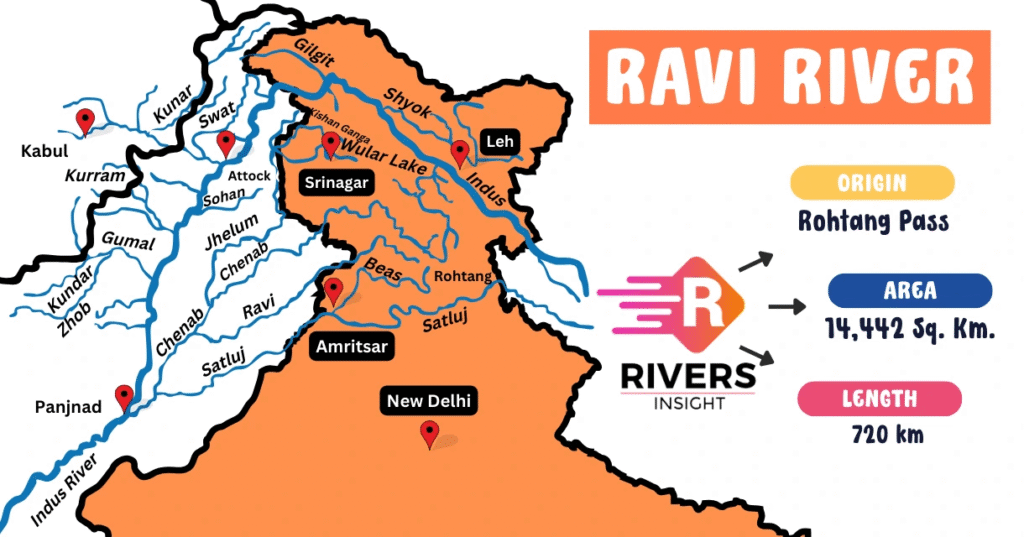

RAVI RIVER

TOPIC: (GS1) GEOGRAPHY: INDIAN EXPRESS

Due to continuous heavy rainfall in hilly regions, the water level of the Ravi River has risen significantly, raising concerns of floods in adjoining areas.

About Ravi River

- A transboundary river flowing through northwestern India and northeastern Pakistan.

- One of the five rivers of Punjab (Punjab = “Land of Five Rivers”).

Origin & Course

- Origin: Northern slopes of Rohtang Pass, Himachal Pradesh.

- Initially flows as two streams – Budhil and Tantgari – which later join.

- Passes through Chamba district (Himachal Pradesh) and receives many tributaries.

- Flows southward into Punjab, then enters Pakistan, where it merges with the Chenab River (a major Indus tributary).

Key Features

- Total Length: 720 km (India: 320 km).

- Catchment Area in India: 14,442 sq. km.

- Flow Pattern: Governed by snowmelt in spring and Southwest Monsoon rains (June–Sept.).

- Major Tributaries: Siul, Baira, and Ujh.

Dams & Projects

- Ranjit Sagar Dam (Thein Dam) – multipurpose (hydropower + irrigation).

- Chamera Dam Complex – Chamera I, II & III (hydropower projects).

Strategic Importance

- Under the Indus Water Treaty (1960), waters of Ravi, Beas, and Sutlej were allocated to India.

- Provides irrigation, hydropower, and drinking water to northwestern India.

PM VIKSIT BHARAT ROJGAR YOJANA

TOPIC: (GS2) GOVERNANCE: PIB

The Prime Minister announced the Pradhan Mantri Viksit Bharat Rojgar Yojana on Independence Day with a budget of ₹1 lakh crore, aimed at boosting youth employment and job creation.

Key Features of the Scheme

Objective

- To generate new employment opportunities, especially in the manufacturing sector, while supporting both employees and employers.

Part A – Support to First-Time Employees

- Targets 1.92 crore new employees registered with EPFO.

- Eligible employees: those earning up to ₹1 lakh salary.

- Incentive: ₹15,000 per employee (in two instalments – after 6 and 12 months).

- A portion of the incentive will be kept in the employee’s savings account.

- Payments made via Direct Benefit Transfer (DBT) using Aadhaar-based payment system.

Part B – Incentives for Employers

- Incentive for employers to hire new workers earning up to ₹1 lakh salary.

- ₹3,000 per month per employee for two years, provided the job is sustained for at least 6 months.

- For the manufacturing sector, incentives continue in the 3rd and 4th years as well.

- Expected to generate around 2.6 crore additional jobs.

- Payments will be transferred to PAN-linked employer accounts.

Significance

- Encourages youth employment and addresses post-pandemic job market challenges.

- Provides financial relief to both employees and employers.

- Strengthens formal employment through EPFO registration.

- Supports India’s push towards becoming a global manufacturing hub.

Conclusion:

The scheme is a dual incentive model—supporting fresh employees with direct cash benefits while motivating employers to expand hiring, especially in manufacturing.