Table of Contents

ToggleCREATING OPPORTUNITIES THROUGH INDIA–ARAB LEAGUE

TOPIC: (GS2) INTERNATIONAL RELATIONS: THE HINDU

On January 30–31, 2026, New Delhi is hosting the 2nd India–Arab Foreign Ministers’ Meeting with delegates from the 22-member Arab League.

India–Arab League Relations

- The Arab League (League of Arab States) was founded in 1945 in Cairo with seven members; today it has 22 countries from North Africa and West Asia.

- India’s engagement was formalised in 2002 through a Memorandum of Understanding (MoU) for structured dialogue.

- The Arab–India Cooperation Forum (AICF) was created in 2008, and India’s Ambassador to Egypt was designated as Permanent Representative to the Arab League in 2010.

- The first AICF meeting took place in 2016 in Bahrain.

- Flagship initiatives include the India–LAS Partnership and Investment Summit and the upcoming India–Arab Chambers of Commerce, Industry and Agriculture.

Key Pillars of Engagement

Strategic Partnerships & Security

- India has signed strategic partnership agreements with Oman (2008), UAE (2015), Saudi Arabia (2019), Egypt (2023), and Qatar (2025).

- Defence cooperation includes joint production of equipment and exports of Tejas aircraft, BrahMos missiles, and artillery guns.

- Maritime security under SAGAR and India’s access to Duqm port in Oman strengthen India’s naval presence.

- LAS countries support India against cross-border terrorism, condemning attacks like Uri and Pulwama.

Trade & Investment

- Bilateral trade between India and LAS stands at $240 billion.

- UAE trade has crossed $115 billion, targeted at $200 billion by 2030.

- Major investment commitments: UAE ($75 billion), Saudi Arabia ($100 billion), Qatar ($10 billion).

- FDI inflows from LAS have crossed $2.5 billion.

- The India–Middle East–Europe Economic Corridor (2023) is a key connectivity initiative.

Energy Cooperation

- LAS supplies 60% of India’s crude oil, 70% of natural gas, and 50% of fertilizers.

- Qatar LNG deal (2024): $78 billion, ensuring 7.5 million tonnes annually for 20 years.

- UAE–India oil reserve agreement: $400 million investment.

- ADNOC–Indian Oil LNG contract (2023): 1.2 million tonnes per year for 14 years.

Digital & Fintech Collaboration

- RuPay card launched in UAE (2019); Indian rupee accepted at Dubai airports (2023).

- Rupee–Dirham settlement system operationalised.

- UPI payments now accepted in Bahrain, Saudi Arabia, Qatar, and UAE.

- India and LAS countries share historic ties and strategic convergence. Cooperation spans energy, trade, defence, fintech, and connectivity.

- The Delhi meeting offers a platform to deepen trust, expand opportunities, and strengthen India’s role in West Asia’s stability and prosperity.

Conclusion:

India–Arab League ties are evolving into a comprehensive partnership built on trade, energy, security, and cultural linkages. The Delhi meeting offers a timely opportunity to strengthen trust and unlock new avenues of cooperation in a turbulent global order.

WILL REMOVING CURBS ON CHINESE FDI HELP INDIA?

TOPIC: (GS3) ECONOMY: THE HINDU

The Ministry of Finance is considering lifting restrictions on Chinese firms bidding for government contracts, imposed after the 2020 Galwan Valley clash. This raises the debate on whether easing curbs on Chinese FDI will benefit India’s economy while balancing national security concerns.

India–China Economic Snapshot (2025–26)

- Trade Deficit Remains High: India’s exports to China grew 37% in the first nine months of 2025–26, led by electronics and marine products.

- However, imports from China continue to dominate, leaving India with a trade deficit of over $85 billion in 2025, making China India’s largest source of imports.

- FDI Trends Diverge: According to UNCTAD (2026), FDI inflows to India surged by 73% to $47 billion in 2025, driven by services and manufacturing.

- In contrast, FDI inflows to China fell for the third consecutive year, declining by 8% to $107.5 billion. This shows India is becoming more attractive for global investors, while China faces slowing inflows.

- Chinese companies like Xiaomi and Oppo remain successful in India’s consumer market, showing that selective Chinese FDI can integrate well into India’s economy.

Potential Economic Benefits

- Boost to Manufacturing: Chinese investments can help expand India’s manufacturing base and attract global supply chains.

- Export Growth: Increased FDI may push India’s exports by integrating into global production networks.

- Trade Deficit Reduction: Allowing investment in non-sensitive sectors could reduce India’s heavy trade deficit with China.

- Examples of Success: Companies like Xiaomi and Oppo have shown that Chinese FDI can thrive in India’s consumer market.

- Emerging Sectors: Electric vehicle (EV) manufacturers from China may find India an attractive destination.

Security Concerns

- Sensitive Sectors: Defence, coastal infrastructure near naval bases, and the digital economy are considered high-risk.

- Data Security Risks: Chinese dominance in digital platforms could lead to data leaks or kill switches during crises.

- Policy Approach: Experts suggest restrictions should be sector-specific, not country-specific, to ensure consistency.

Supply Chain Integration

- Economic Survey 2023–24: Suggested Chinese FDI could help India join global supply chains.

- Challenges:

- Supply chains need low tariffs and easy imports of components.

- India must identify areas where it has competitive advantage.

- Infrastructure and logistics constraints remain barriers.

- Apple Example: India had to make special concessions for Chinese suppliers to support Apple’s manufacturing, showing the complexity of integration.

China’s Gains from Investing in India

- Excess Capacity: China has surplus production and seeks to diversify supply chains abroad.

- Tariff Avoidance: Establishing bases in India helps Chinese firms bypass China-focused tariffs in the U.S. and Europe.

- Access to Market: India offers the fastest-growing consumer market, especially in smartphones.

- India Premium: Geopolitical and economic factors make India an attractive destination compared to saturated markets.

Way Forward

- Clear Red Lines: National security must remain central in deciding sectors open to Chinese FDI.

- Balanced Approach: Encourage investment in non-sensitive sectors while protecting strategic areas.

- Policy Consistency: Move towards sector-based restrictions rather than country-specific bans.

- Infrastructure & Ease of Business: Improve logistics and regulatory environment to attract diversified FDI.

Conclusion

Removing curbs on Chinese FDI could strengthen India’s manufacturing and exports, but only if accompanied by strict safeguards in sensitive sectors. A balanced, sector-specific policy will help India gain economic benefits while protecting national security.

HEALTH SPENDING BY THE CENTRE

TOPIC: (GS2) SOCIAL JUSTICE AND HEALTH: THE HINDU

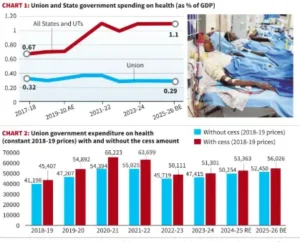

Recent data from the Reserve Bank of India (RBI) highlights that while States and Union Territories have steadily increased their allocations for health since 2017-18, the Union government’s spending has declined.

National Health Policy (2017) Commitments

- The NHP 2017 clearly stated that public health expenditure should rise from 1.15% to 2.5% of GDP by 2025.

- It also proposed that the Centre’s share should be 40% of total public spending on health, which means Union allocations should increase from 0.29% to at least 1% of GDP.

- This required a threefold increase in allocations, but the Union government has not scaled up its budget accordingly.

Current Spending Trends

- State Governments:

- Allocations for health rose from 0.67% of GDP in 2017-18 to 1.1% in 2025-26 (Budget Estimates).

- Share of health in overall state budgets increased from 5% to 5.6%, showing sustained commitment even after COVID.

- Union Government:

- Spending increased moderately during the pandemic but fell afterward.

- Allocation declined from 0.37% of GDP (2020-21 Actuals) to 0.29% (2025-26 BE).

- Share of health in Union Budget fell from 2.26% to 2.05%.

- In real terms, Union allocations in 2025-26 are 4.7% lower than 2020-21, meaning less care can be provided today compared to the pandemic period due to inflation.

International Comparison

- India’s public health spending is among the lowest globally.

- Bhutan: Per capita spending is 2.5 times higher than India.

- Sri Lanka: Spends 3 times more per person.

- BRICS nations: Spend 14–15 times more per capita than India.

- Thailand and Malaysia: Spend at least 10 times more per person.

- This shows India’s health expenditure is far below global standards, leaving its population vulnerable.

Health and Education Cess (HEC)

- Introduced in 2018-19 at 4% of taxable income to boost health and education funding.

- FY2023-24 collection: ₹71,180 crore, but only ₹17,795 crore (25%) went to health. The remaining amount was used to supplement general tax revenue.

- Without cess, Union health allocations fell 22.5% in real terms between 2020-21 and 2023-24, showing poor prioritisation.

Schemes and Transfers

- In 2014-15, nearly 76% of Union health spending was transferred to States for schemes like the National Health Mission (NHM).

- By 2024-25, this fell to 43%, leaving States underfunded despite being the main providers of healthcare.

- Other schemes like Pradhan Mantri Swasthya Suraksha Yojana, nutrition programs, and health research faced severe cuts.

- This reflects hyper-centralisation of resources by the Union government, even though health is primarily a State subject.

Conclusion

The National Health Policy (2017) targets remain unmet, and schemes vital for vulnerable populations are underfunded. Without significant increases in Union allocations and stronger support for programs like NHM, India risks falling further behind global standards in healthcare.

NEW SOLID WASTE MANAGEMENT FRAMEWORK

TOPIC: (GS3) ENVIRONMENT: THE HINDU

The Union government has notified the Solid Waste Management Rules, 2026, making waste processing at the source compulsory for bulk waste generators and urban local bodies.

Solid Waste Situation in India

- Urbanisation and lifestyle changes have led to a sharp rise in waste generation.

- India generates about 1.8–2 lakh tonnes of solid waste every day, with housing societies, offices, and institutions contributing a major share.

- Door-to-door collection has improved in many cities, but waste processing capacity remains insufficient.

- A large portion of waste still ends up in open dumps and landfills, causing pollution and health risks.

- Poor segregation at household and institutional levels increases costs and reduces recycling efficiency.

Earlier Regulatory Framework

- Waste management was governed under the Environment Protection Act, 1986.

- The Solid Waste Management (SWM) Rules, 2016 encouraged segregation, composting, recycling, and decentralised treatment.

- Urban Local Bodies (ULBs) were made primarily responsible for collection and disposal of waste.

- Bulk waste generators (like large housing complexes, institutions) were included in the framework, but enforcement was weak.

- Monitoring and accountability mechanisms were inadequate, limiting the effectiveness of the rules.

Features of SWM Rules, 2026

- Stricter Compliance Framework: New rules will be enforced from April 2026 with stronger monitoring and penalties.

- Urban Local Bodies (ULBs) and bulk waste generators must strictly follow segregation and disposal norms.

- Mandatory Processing at Source: Bulk waste generators (housing societies, institutions, offices, hotels) must treat and process waste at source.

- Promotion of Circular Economy: Emphasis on resource recovery, recycling, and reuse to encourage industries and communities to adopt sustainable waste management practices.

- Higher User Fees for Non-Compliance: Dumping mixed or untreated waste will attract higher user charges.

Who Are Bulk Waste Generators?

- Entities that fall under this category include: Buildings with large floor areas

- Establishments using high volumes of water, Institutions producing over 100 kg of waste daily

This covers apartments, hotels, colleges, offices, and government complexes. - Mandatory Segregation Categories: Waste must now be separated into four streams:

- Wet waste (biodegradable)

- Dry waste (recyclables)

- Sanitary waste

- Domestic hazardous waste (batteries, e-waste, etc.)

- Extended Responsibility of Bulk Generators: Must treat wet waste on-site wherever possible. If not feasible, they must obtain a certified waste processing arrangement.

- Special Powers to Local Bodies: Hill and island regions can charge tourists for waste services. Authorities may limit visitor numbers based on waste-handling capacity.

Importance of Extended Producer Responsibility (EPR)

- Shared Responsibility: Under EPR rules (2022), major producers of plastics, electronics, and packaging must take responsibility for collection and recycling.

- Example: India generates 3.5 million tonnes of plastic waste annually (CPCB, 2023), and producers are now mandated to recycle a fixed percentage of it.

- Decentralised Treatment: Encourages local recycling and treatment facilities, reducing the need to transport waste long distances. Decentralisation lowers costs and improves efficiency in waste handling.

- Promotes Sustainability: Focus on resource recovery — turning waste into usable materials like recycled plastic, compost, or energy. Supports India’s target of reducing single-use plastics by 100% by 2030.

Conclusion

The SWM Rules, 2026 mark a decisive move towards accountable, source-based waste management, supporting India’s transition to a circular and environmentally responsible urban system.

SUSTAINING INDIA’S EXPORT MOMENTUM WITH HIGHER-VALUE PRODUCTS

TOPIC: (GS3) ECONOMY: THE HINDU

The Economic Survey 2025-26 highlights that India can sustain its export growth by diversifying into higher-value products and new markets, even as global trade faces rising protectionism and uncertainty.

Current Global Trade Scenario

- The world economy is becoming fragmented and cautious, with countries prioritising domestic interests.

- Protectionist policies and retaliatory tariffs are reshaping trade flows.

- Supply chains are being recalibrated due to geopolitical tensions and national security concerns.

- Engagement is shifting from multilateral agreements to bilateral deals.

Observations from Economic Survey 2025-26

- Export momentum can be sustained through: Diversification into sophisticated, higher-value products.

- Exploring new destinations beyond traditional markets. Targeted industrial policies and technological upgrades. Building export-driven ecosystems.

- The Trade Policy Uncertainty Index and Global Economic Policy Uncertainty Index peaked in April 2025, reflecting instability in trade agreements and competition for rare earth minerals.

- India’s expanding network of Free Trade Agreements (FTAs) provides reliable market access amid global uncertainty.

Challenges for India’s Export Strategy

- Rising Protectionism: Countries are imposing tariffs and non-tariff barriers. WTO data (2025) shows global tariff actions increased by 12% year-on-year.

- Geopolitical Decoupling: Strategic rivalry among major economies is leading to fragmented supply chains. India risks being caught in competing blocs.

- Dependence on Low-Value Exports: India’s export basket is still dominated by low-value goods like textiles and raw materials. UNCTAD (2024) noted that 70% of India’s exports are medium or low-tech products, limiting competitiveness.

Way Forward

- Diversify into High-Value Sectors: According to EXIM Bank (2025), India’s share in global electronics exports is just 1%, offering huge scope.

- Strengthen Trade Agreements: Expand FTAs with EU, ASEAN, and Africa to secure stable market access. Economic Survey notes FTAs already support $200+ billion trade flows.

- Boost Technology and R&: Invest in innovation and skill development to move up the value chain. NITI Aayog (2025) recommends raising R&D spending from 0.7% of GDP to 2% to match global peers.

Export promotion schemes

- EPCG Scheme – lets exporters import capital goods at zero duty to upgrade technology and boost production.

- RoDTEP Scheme – refunds hidden taxes and duties on exported products to keep Indian goods competitive.

- Interest Equalisation Scheme – provides cheaper credit to exporters, especially MSMEs, by subsidising loan interest.

Conclusion

India’s export growth can be sustained only by shifting towards high-value products, leveraging FTAs, and investing in technology. With rising global uncertainty, a strategic and diversified export policy is essential to secure India’s place in global trade.

ETHANOL BLENDING AND ITS IMPACT ON FOOD SECURITY

TOPIC: (GS3) ENVIRONMENT: THE HINDU

The Economic Survey 2025-26 has cautioned that India’s ethanol-blending programme, while saving huge foreign exchange, may pose risks to food security as maize cultivation expands at the cost of pulses and oilseeds.

India’s ethanol-blending

- India’s ethanol-blending programme aims to reduce dependence on imported crude oil and promote cleaner energy.

- As of August 2025, ethanol blending saved India ₹1.44 lakh crore in foreign exchange and substituted about 245 lakh metric tonnes of crude oil.

- Farmers benefited through higher demand for crops like maize, which is increasingly used for ethanol production.

Emerging Concerns on Food Security

- Expansion of maize acreage is visible in Maharashtra and Karnataka, competing with pulses, oilseeds, soyabean, millets, and cotton.

- Pulses and oilseeds are vital for nutrition and consumption baskets, but are losing priority among cultivators.

- Reduction in paddy acreage, expected earlier, has not materialised. Highlights tension between self-reliance in energy (Aatmanirbharta in fuel) and self-reliance in food.

- Survey warns of imbalance: greater dependence on edible oil imports and higher domestic food price volatility during supply shocks.

Key Challenges

- Shift in Crop Patterns – Rising maize cultivation for ethanol risks reducing acreage of pulses and oilseeds, weakening India’s nutritional security.

- Dependence on Imports – Greater reliance on edible oil imports exposes India to global price fluctuations and supply chain shocks.

- Food vs Fuel Dilemma – Balancing energy security with food security creates policy tensions, as land, water, and labour are diverted from food crops to fuel crops.

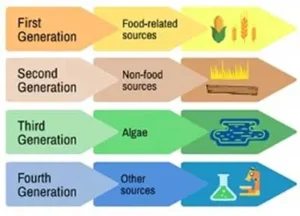

Future Growth of Ethanol Production

- India has set a target of 20% ethanol blending in petrol by 2025-26, advancing from the earlier 2030 deadline.

- Recent expansion of ethanol distilleries and use of multiple feedstocks (sugarcane, maize, damaged grains) is boosting production capacity.

- Government is encouraging second-generation ethanol from agricultural waste to reduce pressure on food crops.

- With crude oil prices volatile and climate concerns rising, ethanol blending remains a critical part of India’s energy transition strategy.

- However, policies must ensure balanced crop diversification and adequate support for pulses and oilseeds to safeguard food security.

Conclusion

A balanced approach promoting non-food feedstocks, supporting pulses and oilseeds, and investing in advanced ethanol technologies is essential to achieve both energy self-reliance and food security.

WINGS INDIA 2026

TOPIC: (GS3) SEQURITY: THE HINDU

India’s civil aviation sector will be showcased at Wings India 2026, Asia’s largest aviation event, scheduled from 28–31 January 2026 at Begumpet Airport, Hyderabad.

About Wings India 2026

- Recognised as Asia’s biggest civil aviation event.

- Serves as a global platform for connectivity, manufacturing, services, innovation, and sustainability.

- Inaugurated by Rammohan Naidu Kinjarapu, Union Minister of Civil Aviation.

- Theme: “Indian Aviation: Paving the Future from Design to Deployment, Manufacturing to Maintenance, Inclusivity to Innovation and Safety to Sustainability.”

India’s Aviation Growth Story

- India is among the fastest-growing aviation markets globally.

- Passenger traffic has multiplied several times in the last decade.

- Record aircraft orders place India among the largest future aircraft markets.

- Rapid expansion of airport infrastructure:

- New Greenfield airports.

- Modernised terminals.

- Regional connectivity under UDAN scheme.

Conclusion:

Wings India 2026 showcases India’s ambition to move from being a fast-growing aviation market to becoming a global aviation leader, integrating infrastructure growth, sustainability, and innovation.

KERALA STATE MICROBE

TOPIC: (GS3) ENVIRONMENT: THE HINDU

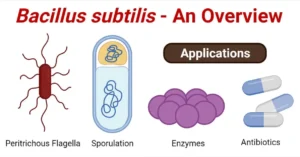

Kerala has become the first State in India to officially notify a State Microbe, declaring Bacillus subtilis during the launch of the Centre of Excellence in Microbiome (CoEM).

About Bacillus subtilis

- A beneficial probiotic bacterium found in soil, water, human gut, and fermented foods.

- Plays a key role in controlling plant diseases, improving soil fertility, and enhancing crop productivity.

- Has strong potential for commercial microbial products in agriculture and biotechnology.

Centre of Excellence in Microbiome (CoEM)

- Established by the Kerala government to study microorganisms in health, environment, and sustainability.

- Focuses on translational research for direct societal benefits.

- Functions under the Kerala State Council for Science, Technology and Environment (KSCSTE) in collaboration with the Kerala Development and Innovation Strategic Council (K-DISC).

What are Betels?

- Betel leaves are widely used in India for chewing, cultural rituals, and traditional medicine.

- They are valued for their antimicrobial properties and socio-cultural significance in daily life and ceremonies.

Why Bacillus subtilis was Selected

- It supports sustainable agriculture by reducing dependence on chemical fertilizers and pesticides.

- Helps in biodiversity conservation and aligns with Kerala’s vision of promoting eco-friendly practices.

- Symbolises the integration of science, environment, and livelihood opportunities.