THE FUTURE OF THE (IMEC) ECONOMIC CORRIDOR

TOPIC: (GS2) INTERNATIONAL RELATIONS: THE HINDU

The IMEC, a multi-country initiative to improve trade connectivity between India, West Asia, and Europe, faces uncertainty due to recent geopolitical tensions in West Asia, but remains vital for India-Europe economic cooperation.

About IMEC

- IMEC envisions maritime and land-based connectivity linking India with the Arabian Peninsula and Europe.

- Key components include:

- High-speed trains from UAE ports to Israel via Saudi Arabia and Jordan.

- Maritime shipping routes connecting India and West Asia.

- Proposed clean hydrogen pipelines, electricity cables, and undersea digital networks.

Objective:

- Strategic Connectivity IMEC is a proposed trade and transport corridor connecting India to Europe via the Middle East. It aims to improve logistics through rail, road, and shipping networks.

- Economic Integration The corridor will boost trade between India, the UAE, Saudi Arabia, Jordan, Israel, and Europe, reducing transit time and costs for goods and services.

- Alternative to China’s Belt and Road IMEC offers a democratic and transparent infrastructure model, positioning itself as a counter to China’s Belt and Road Initiative (BRI).

- Green and Digital Focus The project includes plans for clean energy transport (like hydrogen pipelines) and digital connectivity, supporting sustainable development and innovation.

Historical Background

- Initial optimism came from the Abraham Accords, which improved relations between Israel and Arab nations.

- IMEC was launched with backing from multiple countries, including India, UAE, Israel, EU nations, and the U.S.

- Early plans included railway links from Israel’s Haifa port to Gulf ports, and integration with existing regional infrastructure.

- The initiative was seen as part of broader frameworks like I2U2 to boost regional cooperation.

Geopolitical Challenges

- Hamas attacks and subsequent Israeli military actions disrupted the region, affecting IMEC’s feasibility.

- Security of sea lanes remains unpredictable; recent Red Sea disruptions forced rerouting of goods via the Cape of Good Hope, increasing costs and time.

- IMEC routes must be flexible and adaptable to changing political dynamics.

European Considerations

- Mediterranean countries like France and Italy view IMEC as crucial to maintain influence in global trade amid emerging Arctic shipping routes.

- Europe remains important for India due to high per capita income, technology, and $136 billion trade volume.

- Maintaining Mediterranean connectivity ensures India’s access to European markets even as new Arctic routes emerge.

Strategic and Economic Importance

- IMEC supports India’s goal of diversifying trade away from reliance on a few routes or partners.

- Strengthens India-Arab economic relations, countering regional competition and fostering shared prosperity.

- Offers opportunities to explore additional ports in Saudi Arabia and Egypt, creating resilient logistics and supply chains.

- Acts as a platform for India and Europe to pool resources and enhance economic cooperation across the corridor.

Conclusion:

IMEC is a strategic initiative that can strengthen India’s trade and economic ties with West Asia and Europe. Adapting to geopolitical challenges will be key to unlocking its full potential.

TRADE DEFICIT WIDENS

TOPIC: (GS3) ECONOMY: THE HINDU

India’s trade deficit surged by 93% in September 2025 due to a sharp drop in services exports and a rise in imports. Despite this monthly spike, the overall trade deficit for April–September 2025 declined by 2.3% compared to last year.

About Trade Deficit

- A trade deficit occurs when a country’s imports exceed its exports in value.

- Example: If India imports goods worth $100 billion and exports only $80 billion, the trade deficit is $20 billion.

Implications:

Higher Foreign Dependency:

- Indicates that domestic industries rely heavily on imported raw materials, machinery, or energy.

- For instance, India’s oil and electronics imports significantly contribute to its trade deficit.

Pressure on Domestic Currency:

- Persistent trade deficits increase demand for foreign currency, causing depreciation of the rupee.

- As per RBI data (2025), India’s trade deficit widened to around $265 billion, impacting the rupee-dollar exchange rate.

Impact on Foreign Exchange Reserves:

- Large deficits can drain forex reserves, limiting the country’s ability to manage imports and repay external debt.

Inflationary Effects:

- Imported inflation may occur if the country depends on costly foreign goods (e.g., crude oil).

Key Highlights from September 2025

Monthly Trade Performance

- Exports: Rose slightly by 0.8% to $67.2 billion.

- Imports: Jumped 11.3% to $83.8 billion.

- Deficit: Widened to $16.6 billion from $8.6 billion in September 2024.

Goods vs Services

- Goods Exports: Increased 6.7% to $36.4 billion despite U.S. tariffs.

- Services Exports: Dropped 5.5% to $30.8 billion, pulling down overall export growth.

How Countries Address Trade Deficit

- Boosting Exports:

- Incentives for exporters.

- Diversifying export markets.

- Promoting high-value sectors like IT and pharmaceuticals.

- Reducing Imports:

- Import substitution policies.

- Tariffs and duties on non-essential goods.

- Encouraging domestic manufacturing (e.g., Make in India).

India’s Measures to Manage Trade Deficit

- Production-Linked Incentive (PLI) Schemes: To boost domestic manufacturing.

- Export Promotion Councils: Support exporters with market access and logistics.

- Tariff Adjustments: Strategic use of duties to protect domestic industries.

- Trade Agreements: Negotiating FTAs to reduce barriers and expand exports.

Conclusion:

India’s rising trade deficit in September 2025 highlights the vulnerability of services exports amid global shifts, even as goods exports show resilience. Strategic policy support and diversification will be key to sustaining export momentum and narrowing the gap.

INDIA’S REFUGEE CHALLENGE

TOPIC: (GS2) INDIAN POLITY: THE HINDU

India’s Union Home Minister emphasized the need to differentiate between refugees and infiltrators. This comes amid criticism of inconsistent treatment of refugee groups and the absence of a uniform refugee policy.

Who Are Refugees?

- Refugees are individuals who flee their home country due to war, persecution, or violence and seek safety in another country.

- Global Framework: The 1951 UN Refugee Convention defines refugee rights, but India is not a signatory.

- Indian Context: India lacks a dedicated refugee law, leading to varied treatment of different refugee groups.

Legal Framework in India

1. Absence of a Dedicated Refugee Law

- India is not a signatory to the 1951 UN Refugee Convention or its 1967 Protocol, mainly due to concerns over sovereignty and illegal migration.

- Refugee management is handled under foreigners’ legislations like:

- The Foreigners Act, 1946 – empowers the government to detain, deport, or regulate foreigners.

- The Passport (Entry into India) Act, 1920 – controls entry and exit.

- This legal ambiguity means refugees and illegal migrants are treated alike, lacking a distinct legal status or uniform protection framework.

2. Constitutional and Judicial Safeguards

- Though “refugee” is not defined in Indian law, Article 14 (equality before law) and Article 21 (right to life and personal liberty) extend protection to all persons, citizens or otherwise.

- The Supreme Court in National Human Rights Commission v. State of Arunachal Pradesh (1996) upheld the right to life of Chakma refugees.

- However, in 2021, the Court declined to stay the deportation of Rohingya refugees, citing national security—reflecting India’s balancing of humanitarianism with security interests.

3. Institutional and Administrative Mechanisms

- UNHCR (United Nations High Commissioner for Refugees) operates in India under a 1981 MoU with the government, registering and assisting asylum-seekers, mainly in urban areas.

- The Ministry of Home Affairs (MHA) deals with refugee matters on a case-by-case basis—granting Long-Term Visas (LTVs) to Tibetan and Sri Lankan refugees for residence, education, and employment.

- As of 2025, India hosts around 2.1 lakh refugees and asylum seekers (UNHCR Data 2025), mostly from Myanmar, Afghanistan, and Tibet.

4. Emerging Policy Challenges

- Lack of uniform procedure for status determination leads to arbitrariness and inconsistent treatment across groups.

- The Citizenship (Amendment) Act, 2019 (CAA) allows fast-tracked citizenship for non-Muslim refugees from neighboring countries—seen as a humanitarian but selective approach.

- The Rohingya issue (2023–25) exposed the absence of legal clarity, with states differing on detention and deportation policies.

Need for a Non-Discriminatory Refugee Policy

- A clear, inclusive refugee policy would:

- Ensure equal treatment for all refugee groups.

- Prevent arbitrary decisions and harassment.

- Align India’s humanitarian efforts with global standards.

Citizenship (Amendment) Act, 2019

- Purpose: Offers citizenship to persecuted minorities from Pakistan, Bangladesh, and Afghanistan.

- Criticism: Excludes Muslims, Rohingyas, and Sri Lankan Tamils. Seen as discriminatory and religion-based.

Rationales for the Citizenship (Amendment) Act, 2019

- Religious Persecution: Protects non-Muslim minorities facing persecution in Pakistan, Afghanistan, and Bangladesh.

- Stateless Refugees: Grants citizenship to long-staying undocumented migrants who entered before 2015.

- Cultural Ties: Recognizes civilizational links with persecuted communities sharing Indian heritage.

Recent Developments

- Tamil refugees who arrived before January 9, 2015, and registered with authorities were exempted from penal action under the new immigration law.

- However, selective relief continues to raise concerns over fairness and consistency.

Refugee Influx From Bordering Nations

Sri Lankan Civil War (1983–2009)

- Thousands of Tamil refugees fled to Tamil Nadu.

- Despite long-term stay, no formal rehabilitation policy exists for many.

Rohingya Crisis (2017)

- Ethnic violence in Myanmar led to Rohingya Muslims seeking refuge in India.

- Their status remains uncertain due to lack of documentation and legal protection.

Afghanistan Crisis (2021)

- Taliban’s takeover triggered a wave of Afghan nationals seeking asylum.

- India offered emergency visas but lacks a long-term refugee framework.

Conclusion

India’s refugee management needs a structured, fair, and inclusive policy to uphold humanitarian values while maintaining national security. A uniform legal framework is essential to balance compassion with control.

SECURING CRITICAL MINERALS FOR INDIA’S CLEAN ENERGY FUTURE

TOPIC: (GS3) ECONOMY: THE HINDU

The government has launched the National Critical Mineral Mission (NCMM) to reduce import dependence and strengthen domestic supply chains.

Importance of Critical Minerals in Clean Energy

- Key Role: Minerals like lithium, cobalt, and rare earth elements (REEs) are essential for electric vehicles (EVs), solar panels, wind turbines, and battery storage.

- Energy Targets: India aims for 500 GW of renewable energy by 2030 and net-zero emissions by 2070.

- EV Growth: India’s EV market is expected to grow at 49% CAGR (2023–2030), increasing demand for battery minerals.

India’s Import Dependence

- High Reliance: India imports nearly 100% of lithium, cobalt, and nickel, and over 90% of REEs.

- Global Risks: China dominates REE production and processing, posing supply chain risks amid geopolitical tensions.

Domestic Potential and Exploration

- New Discoveries:

- Lithium reserves found in Jammu & Kashmir and Rajasthan.

- REEs located in Odisha and Andhra Pradesh.

- Policy Push:

- National Mineral Exploration Policy (2016) and MMDR Act (2021) promote private exploration.

- In 2023, 5.9 million tonnes of lithium identified in J&K.

- 20 mineral blocks auctioned recently, attracting global interest.

Building Processing and Recycling Capacity

- Current Gap: India contributes less than 1% to global REE output.

- Need for Action:

- Develop refining and recycling infrastructure.

- Encourage public-private partnerships.

- Support pilot projects with subsidies and tax incentives.

Investment and Policy Measures

- Mining Sector: Contributes only 2.5% to GDP (vs. 13.6% in Australia). Needs simplified licensing and financial incentives.

- Key Initiatives:

- National Critical Mineral Mission (₹34,300 crore plan).

- E-Waste and Battery Waste Management Rules (2022) to boost recycling.

- KABIL formed to acquire overseas mineral assets.

Towards a Circular Economy

- E-Waste Challenge: India generates ~4 million tonnes annually; only 10% is formally recycled.

- Solution: Invest in modern recycling plants. Promote urban mining and recovery from used electronics.

WHAT ARE CRITICAL MINERALS?

Critical minerals are natural elements that are essential for modern technologies and industries, especially clean energy, electronics, and defense.

Why “Critical”? They are called critical because they are:

- Vital for economic and national security

- Often scarce or hard to mine

- Mostly imported due to limited domestic availability

Mineral Use Case Example

Lithium Batteries for electric vehicles (EVs)

Cobalt Rechargeable batteries and aerospace

Nickel EV batteries and stainless steel

Rare Earths Wind turbines, smartphones, defense tech

Graphite Battery anodes and lubricants

Conclusion

India’s clean energy future hinges on securing critical minerals through domestic mining, global partnerships, and circular economy practices. Strong policy support and private sector collaboration are essential to reduce import dependence and lead the green transition.

WEST BENGAL WITH LOW CONVICTION RATES FOR CRIMES AGAINST WOMEN

TOPIC: (GS1) SOCIAL ISSUES: THE HINDU

Recent public outrage over an alleged gang rape in Durgapur has highlighted West Bengal’s poor conviction rates and weak accountability in crimes against women, reigniting concerns about women’s safety in the State.

Background and Context

- Crimes against women remain a major issue in West Bengal, with thousands of cases reported annually.

- The State has consistently ranked among the top five in India for cases of offences against women, including acid attacks, attempts to rape, and cruelty by husband/relatives.

- Despite the high number of cases, conviction rates are extremely low, showing gaps in law enforcement and judicial processes.

Crime Statistics in West Bengal

- Annual cases: Over 30,000 crimes against women reported each year since 2018.

- Specific categories:

- Highest number of acid attacks and attempts.

- Second-highest in attempt to rape cases.

- Third-highest in cruelty by husband/relatives.

- Overall ranking: Among top five States for multiple categories of crimes against women.

Conviction and Acquittal Data

- Average conviction rate (2017–2023): Around 5%, among the lowest in India.

- State ranking: 35th out of 36 in conviction rates for crimes against women in 2023.

- Acquittals: Rose sharply to over 19,000 in 2023, the highest in India.

- Pending cases: Approximately 3.7 lakh cases awaiting trial at the end of 2023, marking a 56% increase since 2017.

Recent Developments

- The Durgapur incident involved a medical student from Odisha, sparking protests and public outrage.

- Chief Minister Mamata Banerjee called for greater responsibility by private colleges and advised students, particularly girls, not to venture out at night, attracting criticism for shifting responsibility.

- Previous guidelines in the State, such as reducing night duty for women doctors, were withdrawn after Supreme Court scrutiny.

Implications

- Low convictions and rising pendency indicate weak enforcement and judicial bottlenecks.

- Public perception of inadequate action undermines women’s safety and trust in law enforcement.

- There is an urgent need for:

- Faster investigations and trials

- Strengthening legal accountability

- Preventive measures and public awareness for women’s safety

Conclusion:

West Bengal faces a dual challenge — a high incidence of crimes against women and poor conviction rates, resulting in massive backlogs and rising acquittals. Effective policing, judicial reforms, and societal change are crucial to improve women’s safety in the State.

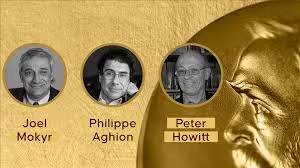

NOBEL PRIZE IN ECONOMICS 2025

TOPIC: (GS3) ECONOMY: THE HINDU

The 2025 Nobel Prize in Economic Sciences was awarded to Philippe Aghion, Peter Howitt, and Joel Mokyr for their pioneering work on how innovation drives long-term economic growth.

What Was Their Contribution?

- The trio explored how economies grow through innovation, technological change, and knowledge creation.

- Their work explains why some countries progress rapidly while others lag behind.

- They built on the idea of “creative destruction”, where new technologies replace old ones, leading to economic transformation.

Background of the Theory

- The concept of creative destruction was first introduced by Joseph Schumpeter, who saw capitalism as a dynamic system where innovation constantly replaces outdated methods.

- Aghion and Howitt refined this idea in the 1990s using endogenous growth theory, which says that growth comes from within the economy, through education, research, and competition, not from external factors.

- Joel Mokyr added historical and cultural depth, showing how societies that embraced new ideas and knowledge advanced faster.

Why This Matters Today

- Their research highlights the importance of open markets, scientific freedom, and private enterprise in driving innovation.

- However, current global trends like protectionism, trade wars, and state-led innovation (e.g., China), challenge the ideal conditions their models assume.

- The Nobel Prize serves as a reminder that liberal democracies must protect institutional freedoms to sustain innovation and growth.

Relevance to India and the World

- The models support policies that promote:

- Investment in education and R&D

- Encouragement of startups and competition

- Protection of intellectual freedom

- For India, this aligns with initiatives like Startup India, Digital India, and Atmanirbhar Bharat, which aim to boost innovation-driven growth.

Conclusion

The 2025 Economics Nobel celebrates the power of innovation in shaping economies. It also warns that without open institutions and free markets, the engines of progress may stall — a lesson especially relevant in today’s changing global order.

FLAWED FISCAL ARCHITECTURE OF MUNICIPALITIES

TOPIC: (GS2) INDIAN POLITY: THE HINDU

Urban India generates nearly two-thirds of the national GDP, yet municipalities control less than 1% of tax revenue. Experts have highlighted the flawed fiscal architecture of municipalities and the potential role of municipal bonds in bridging the finance gap.

Fiscal Architecture of Municipalities

- Low Revenue Share: Municipalities receive less than 1% of India’s total tax revenue despite managing critical urban services.

- Dependence on Transfers: Most municipal finance comes from State and Central government grants, loans, and schemes rather than own revenue.

- Centralisation of Taxes: Post-GST, cities lost around 19% of their own revenue sources like octroi, entry tax, and local surcharges. Compensatory mechanisms largely bypass municipalities.

- Limited Fiscal Autonomy: Municipalities cannot plan long-term projects due to unpredictable revenues, while being responsible for services like waste management, housing, water supply, and urban infrastructure.

Municipal Bonds?

- Current Scenario: Municipal bonds are promoted as a tool for local financing but remain underutilized due to low credibility.

- Creditworthiness Issue: Ratings focus only on a city’s “own revenue” ignoring regular grants and transfers, creating a distorted view of municipal finances.

- Grants as Legitimate Income: Constitutionally mandated grants should be considered part of the city’s revenue, not charity.

Revenue Sources of Municipalities

- Own Sources (20-25% of potential revenue):

- Property tax

- User charges (water, sewage, waste management)

- Fees, licenses, and local taxes

- Shared Taxes & Grants:

- State government grants (tax devolution from GST or other taxes)

- Central government schemes (AMRUT, Smart Cities Mission, etc.)

- Borrowings:

- Loans from banks, financial institutions, and municipal bonds

Expenditure Responsibilities

- Solid waste management

- Water supply and sanitation

- Street lighting and public infrastructure

- Affordable housing and urban development projects

- Climate resilience and disaster management

Way Forward

- Fiscal Autonomy: Municipalities should have predictable, untied revenues from both own sources and mandated transfers.

- Municipal Bonds: Credibility can improve if grants and shared taxes are recognized as income and rating systems include governance metrics.

- Learning from Abroad: Scandinavian countries allow municipalities to levy income taxes directly, creating transparency, accountability, and fiscal health.

- Cooperative Federalism: Restoring the principle where cities are treated as equal tiers of governance, not cost centers.

Conclusion:

Strengthening municipal finances and fiscal autonomy is essential for sustainable urban growth. Recognizing grants as legitimate income and empowering cities to raise funds can transform them into engines of national prosperity.

BIOTECH SURGE BUILDS MOMENTUM BUT FACES SCALING BOTTLENECKS

TOPIC: (GS3) SCIENCE AND TECHNOLOGY: THE HINDU

Urban India generates nearly two-thirds of the national GDP, yet municipalities control less than 1% of tax revenue. Experts have highlighted the flawed fiscal architecture of municipalities and the potential role of municipal bonds in bridging the finance gap.

Fiscal Architecture of Municipalities

- Low Revenue Share: Municipalities receive less than 1% of India’s total tax revenue despite managing critical urban services.

- Dependence on Transfers: Most municipal finance comes from State and Central government grants, loans, and schemes rather than own revenue.

- Centralisation of Taxes: Post-GST, cities lost around 19% of their own revenue sources like octroi, entry tax, and local surcharges. Compensatory mechanisms largely bypass municipalities.

- Limited Fiscal Autonomy: Municipalities cannot plan long-term projects due to unpredictable revenues, while being responsible for services like waste management, housing, water supply, and urban infrastructure.

Municipal Bonds?

- Current Scenario: Municipal bonds are promoted as a tool for local financing but remain underutilized due to low credibility.

- Creditworthiness Issue: Ratings focus only on a city’s “own revenue” ignoring regular grants and transfers, creating a distorted view of municipal finances.

- Grants as Legitimate Income: Constitutionally mandated grants should be considered part of the city’s revenue, not charity.

Revenue Sources of Municipalities

- Own Sources (20-25% of potential revenue):

- Property tax

- User charges (water, sewage, waste management)

- Fees, licenses, and local taxes

- Shared Taxes & Grants:

- State government grants (tax devolution from GST or other taxes)

- Central government schemes (AMRUT, Smart Cities Mission, etc.)

- Borrowings:

- Loans from banks, financial institutions, and municipal bonds

Expenditure Responsibilities

- Solid waste management

- Water supply and sanitation

- Street lighting and public infrastructure

- Affordable housing and urban development projects

- Climate resilience and disaster management

Way Forward

- Fiscal Autonomy: Municipalities should have predictable, untied revenues from both own sources and mandated transfers.

- Municipal Bonds: Credibility can improve if grants and shared taxes are recognized as income and rating systems include governance metrics.

- Learning from Abroad: Scandinavian countries allow municipalities to levy income taxes directly, creating transparency, accountability, and fiscal health.

- Cooperative Federalism: Restoring the principle where cities are treated as equal tiers of governance, not cost centers.

Conclusion:

Strengthening municipal finances and fiscal autonomy is essential for sustainable urban growth. Recognizing grants as legitimate income and empowering cities to raise funds can transform them into engines of national prosperity.